Antitrust as a Barometer of Big Government

Over its history, antitrust law has provided a good measure of the changing views of the relative beneficence of the market and the state. When the market enjoys social respect, antitrust law has a circumscribed focus, both because the market is thought to discipline itself, and because the state is understood to have trouble figuring out when it can do better. But when the body politic becomes disenchanted with the market and enthusiastic about the capacity of the state, antitrust advocates enlist judges and bureaucrats as a roving commission to make the world a better place.

The pro-market view dominated the early era of the Sherman Act in the late 19th century and holds sway today. But between these eras, antitrust became a tool of big government. And sadly today, this pro-government model has again become popular not only with the left but also with some on the right. This stirring suggests trouble ahead not only in competition law but for friends of liberty and limited government more generally.

The two most important components of antitrust laws are restrictions on restraints of trade among competitors and on monopolization by single firms. The early years offered some excellent opinions that discovered the appropriate limitations on the scope of both antitrust law and the discretion of those who would enforce it. In Standard Oil v. United States, Chief Justice Edward White argued correctly that the prohibition of monopolization applied only to anti-competitive conduct by monopolists. It did not attempt to outlaw monopolies or what White called “monopoly in the concrete.” In United States v. Addyston Pipe & Steel Co., William Howard Taft, sitting then as circuit judge long before he became President, held that even competitors might make agreements among themselves if they could show these agreements contributed to efficiencies. But he also held that the judges nevertheless had no power to bless such agreements on the grounds they created reasonable prices, because judges would then be on “a sea of doubt.” Taft understood that the market itself was an information system that no bureaucrats, including those in black robes, could replicate.

For decades, beginning in the 1920s, antitrust law became much less sensible. Woodrow Wilson defeated Taft in the election of 1912 and one of his Supreme Court appointments was Louis Brandeis, a jurist who embodied the progressive confidence that government could know better than the market. In the Chicago Board of Trade case, he upheld a price agreement between competitors without showing it was necessary to productive efficiencies. Worse, he suggested that competition was not defined by a baseline of the free market, but instead by the government’s view of all the facts and circumstances of an industry. This opinion shows that it is a mistake simply to understand the progressive view of antitrust as one that always rules against business. What fundamentally distinguishes Brandeis from Taft instead is the former’s confidence that he can tell whether businesses are providing the appropriate price and quality of goods. The arrogance of his opinion is captured by the extraordinary fact that he dismissed the government’s claim of price fixing without even remanding it to the lower courts for fact-finding.

In the New Deal era, courts also began to effectively hold that monopoly power was itself a basis of liability. In United States v. Alcoa, Judge Learned Hand, himself a progressive, suggested that monopolists should be condemned unless they could show that monopoly had been somehow thrust upon them. This perspective undermined the rewards for business innovation. Antitrust reached its nadir, as with so much of law, in the Warren Court. In the Brown Shoe case, Chief Justice Warren condemned mergers of small shoe companies on the idea that he could foresee a trend in consolidation. Brown Shoe embodies judicial hubris in competition law as much as any Warren court decision in constitutional law.

Today, however, the Court’s antitrust jurisprudence is sounder than its constitutional law jurisprudence. In Verizon Communications v. Trinko, Justice Antonin Scalia wrote a hymn to the virtues of permitting businesses to seek a monopoly, because that pursuit encouraged innovation and skill to the benefit of consumers. Scalia implied that these animal spirits are the lifeblood of the economy. And this opinion commanded a unanimous court. Justices Stephen Breyer and Ruth Bader Ginsburg subscribe to the pro-market model of antitrust more than the justices they replaced.

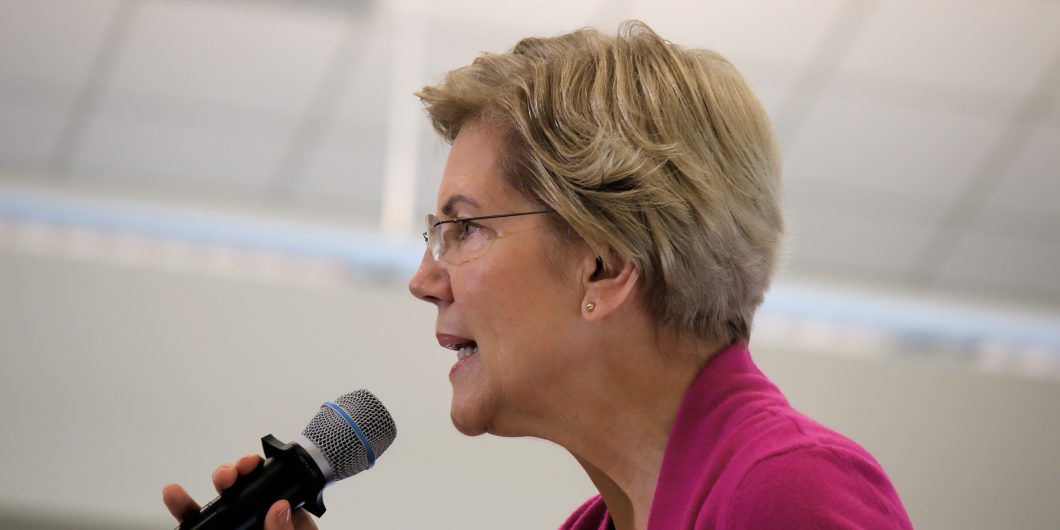

Outside the Court today, however, ominous signs are gathering that the pro-government model is making a comeback. One of Elizabeth Warren’s leading campaign ideas is to break up the big tech companies, requiring them to serve only as platforms for others’ products. For instance, Google could not promote its own maps or Amazon could not sell its own products. Warren is returning to the view that monopolies should be condemned without requiring proof of bad conduct.

The dangers of this view are twofold. First, it reduces incentives to innovate, because companies cannot be sure of fully reaping the rewards of their investments. It might be argued that this is not a problem, because surely even if broken up, the founders and early shareholders in these companies will have done well. But that is a mistaken perspective. Tech is a very risky business. For every Google and Amazon, there are hundreds—if not thousands—of tech ventures that have gone nowhere. Without the prospect of great risk-adjusted returns, tech entrepreneurs would go into safer lines of work (like being a professor). Venture capital would also invest in less risky companies.

Second, breaking up these companies is easier said than done. The government lacks the knowledge to create new firms that will work well. For instance, it may well be that if Google apps are spun off they will lose important synergies from research. If Amazon cannot be permitted to get into the food industry by buying Whole Foods, opportunities for shaking up the complacent grocery business will be lost. That point is not speculative: other large grocery companies lost market capitalization when Amazon bought this small toehold, because their investors feared that a newly invigorated Whole Foods would undermine their business model. Government divestiture will not only destroy value, but decrease competition.

This sorry history of antitrust law progressivism may understate the dangers of its revival. We live in a world of great technological acceleration spurred by ever increasing power of computation. As a result, it is even less likely that monopolies will be able to entrench themselves. IBM was thought to have a monopoly before it ceded primacy to Microsoft, which in turn has lost its place to Google as the gateway to computation. And technological acceleration also makes it harder for governments to figure out what new business practices are exclusionary and what are not, let alone how best to break up companies in an ever-changing technological landscape. As a result, faith in bureaucratic judgement to replace the market is less justified than ever before. Progressive antitrust in the 21st century would thus be even more of a mistake than it was in the 20th.