On August 15, 1971, President Nixon put the economic and financial world into a new era.

Federal Housing Regulators Have Learned and Forgotten Everything

Should the government subsidize buying houses that cost $1.2 million? The answer is obviously no. But the government is going to do it anyway through Fannie Mae and Freddie Mac. The Federal Housing Finance Authority (FHFA) has just increased the size of mortgage loans Fannie and Freddie can buy (the “conforming loan limit”) to $970,080 in “high cost areas.” With a 20% down payment, that means loans for the purchase of houses with a price up to $1,212,600.

Similarly, the Federal Housing Administration (FHA) will be subsidizing houses costing up to $1,011,250. That’s the house price with a FHA mortgage at its increased “high cost” limit of $970,800 and a 4% down payment.

The regular Fannie and Freddie loan limit will become $647,200, which with a 20% down payment means a house costing $809,000. The median U.S. price sold in June 2021 was $310,000. A house selling for $809,000 is in the top 7% in the country. One selling for $1,212,600 is in the top 3%. To take North Carolina for example, where house prices are less exaggerated, an $809,000 house is in the top 2%. For FHA loans, the regular limit will become $420,680, or a house costing over $438,000 with a 4% down payment—41% above the national median sales price.

Average citizens who own ordinary houses may think it makes no sense for the government to support people who buy, lenders that lend on, and builders that build such high-priced houses, not to mention the Wall Street firms that deal in the resulting government-backed mortgage securities. They’re right.

Fannie and Freddie, which continue to enjoy an effective guarantee from the U.S. Treasury, will now be putting the taxpayers on the hook for the risks of financing these houses. Through clever financial lawyering, it’s not legally a guarantee, but everyone involved knows it really is a guarantee, and the taxpayers really are on the hook for Fannie and Freddie, whose massive $7 trillion in assets have only 1% capital to back them. FHA, which is fully guaranteed by the Treasury, has in addition well over a trillion dollars in loans it has insured.

By pushing more government-sponsored loans, Fannie, Freddie, its government conservator, the FHFA, and sister agency, the FHA, are feeding the already runaway house price inflation. House prices are now 48% over their 2006 Housing Bubble peak. In October, they were up 15.8% from the year before. As the government helps push house prices up, houses grow less and less affordable for new families, and low-income families in particular, who are trying to climb onto the rungs of the homeownership ladder.

As distinguished housing economist Ernest Fisher pointed out in 1975:

[T]he tendency for costs and prices to absorb the amounts made available to prospective purchasers or renters has plagued government programs since…1934. Close examination of these tendencies indicates that promises of extending the loan-to-value ratio of the mortgage and extending its term so as to make home purchase ‘possible for lower income prospective purchasers’ may bring greater profits and wages to builders, building suppliers, and building labor rather than assisting lower-income households.

The reason the FHFA is raising the Fannie and Freddie loan-size limits by 18%, is that its House Price Index is up 18% over the last year. FHA’s limit automatically goes up in lock step with these changes. These increases are procyclical acts. They feed the house price increases, rather than acting to moderate them, as a countercyclical policy would do. Procyclical government policies by definition make financial cycles worse and hurt low-income families, the originally intended beneficiaries.

The contrasting countercyclical objective was memorably expressed by William McChesney Martin, the longest-serving Chairman of the Federal Reserve Board. In office from 1951 to 1970, under five U.S. presidents, Martin gave us the most famous of all central banking metaphors. The Federal Reserve, he said in 1955, “is in the position of the chaperone who has ordered the punch bowl removed just when the party was really warming up.”

Long after the current housing price party has gotten not only warmed up, but positively tipsy, the Federal Reserve of 2021 has, instead of removing the punch bowl, been spiking the punch. It has done this by, in addition to keeping short term rates at historically low levels, buying hundreds of billions of dollars of mortgage securities, thus keeping mortgage rates abnormally low, and continuing to heat up the party further.

In general, what a robust housing finance system needs is less government subsidy and distortion, not more.

In fact, the government has been spiking the housing party punch in three ways. First is the Federal Reserve’s purchases of mortgage securities, which have bloated its mortgage portfolio to a massive $2.6 trillion, or about 24% of all U.S. residential mortgages outstanding.

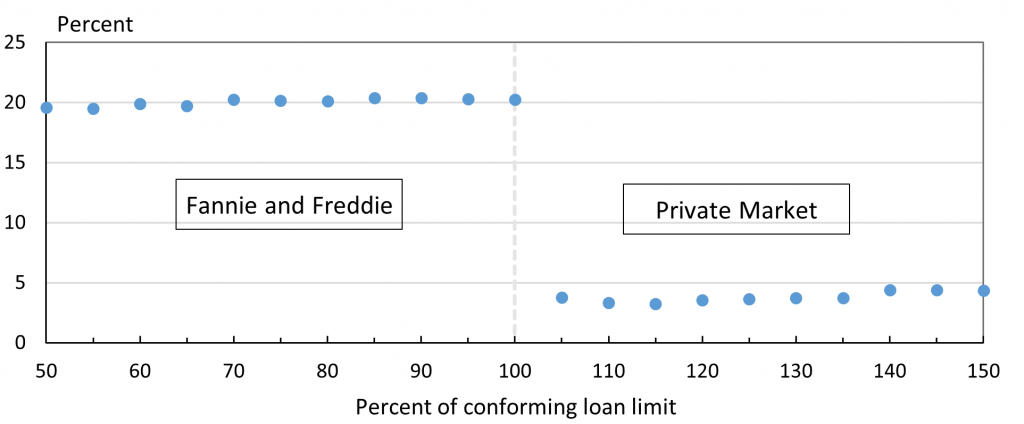

Second, the government through Fannie and Freddie runs up the leverage in the housing finance system, making it riskier. This is true of both leverage of income and leverage of the asset price. It is also true of FHA lending. Graph 1 shows how Fannie and Freddie’s large loans have a much higher proportion of high debt-to-income (DTI) ratios than large private sector loans do. In other words, Fannie and Freddie tend to lend more against income, a key risk factor.

Graph 1: Percent of loans over 43% DTI ratio

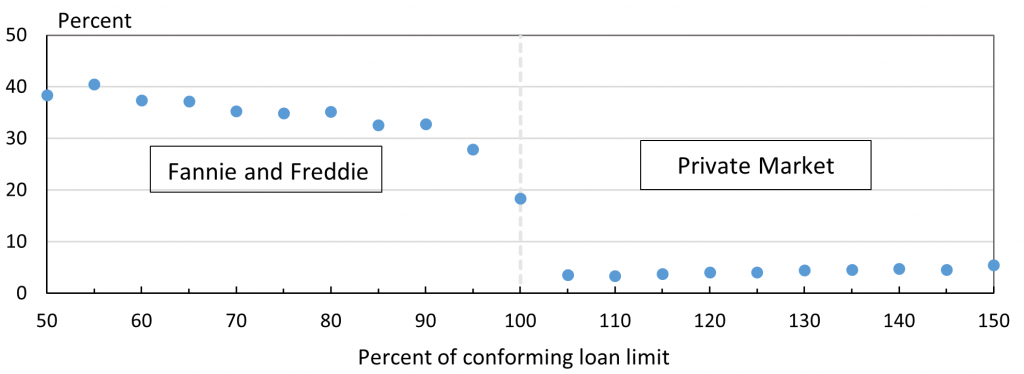

Fannie and Freddie also make a greater proportion of large loans with low down payments, or high loan-to-value (LTV) ratios, than do corresponding private markets. Graph 2 shows the percent of their large loans with LTVs of 90% or more—that is, with down payments of 10% or less—another key risk factor.

Graph 2: Share of loans with LTV ratios over 90%

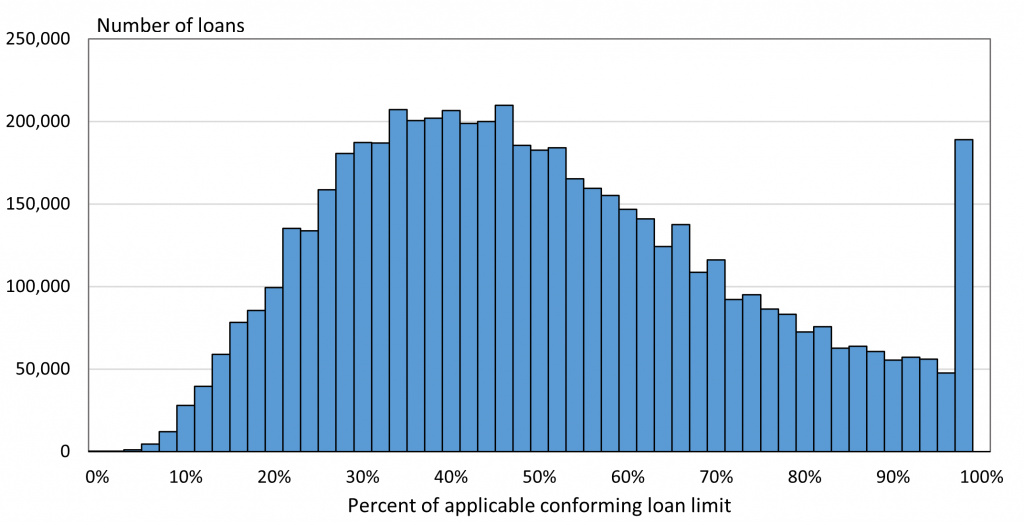

Now—on top of all that– the FHFA, by upping the loan sizes for Fannie and Freddie, is bringing to the party a bigger punch bowl. That the size limit for Fannie and Freddie is very important in mortgage loan behavior, we can see from how their large loans bunch right at the limit, as shown by Graph 3.

Graph 3: Distribution of loans relative to limit

Source: Fisher, Lynn M., et al. “Jumbo rates below conforming rates: When did this happen and why?.” Real Estate Economics 49.S2 (2021): 461-489.

The third spiking of the house price punch bowl consists of the government’s huge payments and subsidies in reaction to the pandemic. A portion of this poorly targeted deficit spending money made its way into housing markets to bid up prices.

A key housing finance issue is the differential impact of house price inflation on lower-income households. AEI Housing Center research has demonstrated how the spiked punch bowl has inflated the cost of lower-priced houses more than others. This research shows that rapid price increases crowd out low-income potential home buyers in housing markets. Thus, as Ernest Fisher observed nearly 50 years ago, government policies that make for rapid house price inflation constrain the ability to become homeowners of the very group the government professes to help.

In general, what a robust housing finance system needs is less government subsidy and distortion, not more. The question of upping the size of Fannie and Freddie loans, and correspondingly those of the FHA, is part of a larger picture of what the overall policy for them should be. Should we favor making their subsidized, market distorting, taxpayer guaranteed activities even bigger than the combined $8 trillion they are already? Should they become even more dominant than they are now? Or should the government’s dominance of the sector and its risk be systematically reduced? That would be a movement toward a mortgage sector that is more like a market and less like a political machine.

In short, what about the future of the government mortgage complex, especially Fannie and Freddie: Should they be even bigger or smaller? We vote for smaller.

How might this be done? As a good example, Senator Patrick Toomey, the Ranking Member of the Senate Banking Committee, has introduced a bill that would eliminate Fannie and Freddie’s ability to subsidize loans on investment properties, a very apt proposal. It will not advance with the current configuration of the Congress, but it’s the right idea. Similarly, it would make sense to stop Fannie and Freddie from subsidizing cash-out refis, mortgages that increase the debt on the house. Another basic idea, often proposed historically, but of course never implemented, would be to reduce, not increase, the maximum size of the loans Fannie and Freddie can buy, and by extension, FHA can insure.

In the meantime, the house price party rolls on. How will it end after all the spiked punch? Doubtless with a hangover.