Restoring Competition in Big Tech

Witnessing a debate between New Brandeisians and free-market fundamentalists can be frustrating at times, as the former wish to attack most competition problems through antitrust, and the latter often refuse to acknowledge that antitrust misses certain anticompetitive conduct. There is another way, which recognizes certain competition problems but does not think antitrust is the right tool for every job. We have more than one tool in our competition toolkit! To his credit, Kristian Stout notes the absurdity to “regard tools like antitrust law as a policy cure-all for any behavior of a Big Tech firm that is found to be objectionable.” Although he allows for such objectionable behavior to be “confronted through a democratic process,” Stout never explicitly calls for legislation outside of antitrust, such as privacy or nondiscrimination protections, which would demonstrate the sincerity of his argument.

In addition to the false choice of antitrust or bust when it comes to remedies, we have to get away from choosing whether Big Tech is our savior or our nemesis. Big Tech can do wonderful things to improve our lives, and it also can do certain things that are anticompetitive. The trick is to preserve the goodness while eradicating the bad acts. Stout begins the piece by reciting all the wonderful things Big Tech does. A modest intervention that stops certain anticompetitive practices, such as misappropriation of a rival’s data to create a clone, would not threaten those wonderful things. There is no evidence to suggest, for example, that the 1992 Cable Act’s nondiscrimination protections harmed a single cable operator’s ability to compete in programming or in video distribution.

To Bend or Not To Bend Antitrust’s Standard

Stout properly criticizes Senator Amy Klobuchar’s proposal to bend the standards in antitrust, so as to capture exclusionary practices that elude scrutiny under the way courts interpret section 2 of the Sherman Act. In particular, antitrust cannot get at certain forms of potentially anticompetitive exclusionary conduct such as self-preferencing that stays within a firm’s boundaries. Google (Amazon) doesn’t need to contract with anyone to give its own content (merchandise) preference in search results. In contrast, conduct that crosses outside a firm’s boundaries and implicates a third-party distributor or customer is squarely within antitrust’s crosshairs. Moreover, these discriminatory practices do not generate short-run price or output effects, but instead threaten edge innovation: Several independent merchants have expressed reservations about selling on Amazon’s platform, in fear of having their merchandise cloned. If would-be merchants decide Amazon’s playing field is too unlevel, they might throw in the towel, depriving consumers of their talents. Alas, such innovation harms are considered an “and also” effect under antitrust, meaning that innovation harms by themselves are not sufficient to prevail under the current standards; courts are reluctant to intervene when they cannot see and measure the harms today, making price or output effects paramount. Policymakers who are convinced that such practices harm competition over the long run are confronted with two choices: (1) bend the antitrust standards à la Senator Klobuchar’s proposal, or (2) attack the conduct via regulation outside of antitrust. I am proponent of the second approach, which I described in my submission to the House Antitrust Subcommittee.

When the Supreme Court oversteps its bounds and makes a mockery of antitrust’s standards, however, a legislative strike that resets the original evidentiary standard is in order. In Ohio v. American Express, which condoned the use of “anti-steering” provisions in merchant contracts to discourage efforts to persuade customers to use lower-cost credit cards, the majority wrongly decided to place the burden of accounting for offsetting benefits (“offsets”) on plaintiffs. Under traditional antitrust approaches, it has long been the burden of defendants to establish efficiency defenses—that is, to connect a purported benefit to the restraint that redounds to plaintiffs (as opposed to some third party), and to quantify it. Following Philadelphia National Bank, in which the Supreme Court applied the antitrust laws to a bank merger, an offset to a third party arguably should be barred from consideration, but at worst, it should be considered a special type of efficiency in two-sided markets, where defendants bear the burden of proof, as suggested by Justice Breyer in his dissent in American Express. Stout is silent here, suggesting a callousness to errors in burden assignment that undermine antitrust plaintiffs.

The Fixation on Size

Stout correctly admonishes the New Brandeisians for their fixation on market structure and attack on bigness. Bigness is not the offense. It is the combination of bigness (market power really) and a restraint on other firms that generates the anticompetitive effect. Neither one on its own is sufficient. While it’s true that we could limit the ability of firms to inflict harms on competition by cutting them down in size, it seems like a distraction from what is important—namely, to enforce the antitrust laws (or some other regulation) against exclusionary conduct by firms with market power. Where the conduct fits an antitrust rubric such as exclusive dealing or discriminatory refusal to deal, the conduct can be enjoined via a court order or consent decree. When the conduct does not fit an antitrust rubric, such as self-preferencing or misappropriation of a supplier’s data, the conduct can be policed via sector-specific regulation.

This is not to say Big Tech should get a pass on antitrust. Even though cloning and self-preferencing don’t squarely fit the antitrust framework, there are some good antitrust cases that merchants, state attorneys general, or the DOJ could bring against Amazon, including Amazon’s tying of its fulfillment services to a merchant’s unfettered access to Amazon’s platform. (Binding arbitration clauses in Amazon’s merchant contracts bar merchants from seeking relief in an antitrust court). Ditto for Amazon’s most-favored-nation clauses, which prevent merchants from charging rival distributors a lower price than what they charge to Amazon. Facebook’s discriminatory refusal to supply API to rival apps such as Vine also fits squarely within the antitrust rubric. Stout is silent on these types of exclusionary conduct.

New Brandeisians are correct to point out that bigness generates harms via the political process, as elected officials tend to do the bidding of larger actors in the economy to the detriment of smaller actors. To wit, as I am writing this piece, state officials are threatening, presumably at the behest of large employers, to restrict unemployment benefits to workers who are refusing to go back to unsafe work environments. And the Senate leader is offering to shield employers from liability when workers get sick on the job. Cutting down firm size via antitrust is certainly one, albeit blunt, solution to this problem of a growing power imbalance between workers and employers. (Economists recognize the correlation between higher concentration and declining labor share within an industry, although they bicker over the causal story.) But a more direct approach would be to reform the way elected officials depend on contributions from large employers, or to reinvigorate unions to provide a counterbalance to monopsony power. Even if every employer was atomistic, as fantasized by the New Brandeisian, to the extent employers could band together via trade associations, they could still jointly lobby for (and contribute to) anti-worker policies.

To borrow another example of the misguided fixation on size, do we really want mom-and-pop airline carriers? Or mom-and-pop Internet providers? If market forces don’t compel airlines to make seat sizes sufficiently large for safety and dignity, then we should just legislate minimum seat sizes. But don’t expect competition to solve this problem, or many like it in vulnerable after-markets.

New Brandeisians Are Not Uniquely Political

Stout is quick to characterize the New Brandeisian focus on concentration as a politicization of antitrust law: “Further, if enforcers and courts were to roll back over a century of antitrust evolution in order to incorporate overtly political ends in enforcement, the net effect would be less democratic.” Yet he must recognize that the Court’s recent chipping away at antitrust protections—say, by denying class-action rights to employees or merchants whose contracts include binding arbitration clauses—also reflects a political ideology. That it’s a political statement in favor of powerful economic actors does not make it any less political. It’s not helpful to accuse the New Brandeisians of politicizing antitrust, especially when your own side seeks to please its own constituency of plutocrats. It’s also not helpful to call them Hipsters, but I digress.

While Stout is right to argue that some industries are naturally prone to economies of scale, tipping, and winner-takes-all concentration, it doesn’t follow that regulators should take a lax attitude towards mergers and acquisitions. A monopoly achieved through superior business acumen or natural barriers to entry, such as direct or indirect network effects, is not problematic on its face. In contrast, a monopoly achieved by eliminating nascent rivals via “killer acquisitions” is unnatural and should be questioned. The FTC appears to have missed, with the benefit of hindsight, a myriad of acquisitions by Big Tech that eliminated the prospect of platform-based competition. And while it’s true that wireless prices and concentration appear to be negatively correlated, as Stout points out, it doesn’t mean we should root for anticompetitive mergers in the highly concentrated wireless industry. In addition to ignoring the warnings of standard economic models, which produce price effects in the face of high diversion ratios, the DOJ ignored empirical evidence of price effects from other four-to-three mergers in wireless.

Stout seems to think that dynamism and competition “for the market” can be counted on to unseat monopoly tech platforms. But how many years has Google been dominant in search? Or Facebook in social media? Or Amazon in online commerce? At some point, the notion that these monopolies are entrenched must be recognized. And while even the best of us believed seven years ago these titans might invade each other fiefdoms, that time (and the failure of Google+) has long passed. Yet Stout still believes: “Not only are Big Tech companies trying to avoid their own Schumpetarian demise from unforeseen direct upstarts, they are competing vigorously with each other.”

Don’t Ignore Direct Evidence of Market Power

Stout places too much emphasis on indirect proof of market power, by insisting on the proper definition of a relevant market as a prerequisite to studying anticompetitive effects. American Express demonstrates the perils of forcing everything through the market-definition funnel. This indirect approach to assessing market power is inferior to direct evidence that a tech platform has the ability to reduce prices for suppliers below competitive levels or exclude rivals. Fortunately, antitrust considers both direct and indirect evidence of market power. A large market share, combined with entry barriers, in a relevant antitrust market allows one to infer market power. But why make such an inference when direct evidence is abundantly clear. As Professor William Kovacic, director of the Competition Law Center at George Washington University Law School and a former chairman of the FTC, explained in ProPublica on April 26:

Sellers favoring Amazon over other retailers could be a sign of market power. That everybody does just what you want and puts you first out of fear that if they fall out of favor with you, they’re in real trouble—that could be taken as proof of your market power. How people regard you, how they react to you, how they respond to your wishes is an indication of whether you have market power, and that is a key issue in these cases. If people say, ‘We don’t dare alienate them,’ that is a part of that proof. You have market power with respect to retailing and distribution because everyone knows if they disappoint you there will be a heavy price to pay. . . . The crisis reinforces the position of significance that they had before.

In other words, Amazon’s market power can be shown directly, with evidence that Amazon can exclude rival distributors by denying them access to inventory, without having to define a relevant antitrust product market. Amazon’s ability to lock up merchants by threatening to downgrade them in search if the merchant’s inventory falls below a certain threshold is consistent with market power. Similarly, Amazon’s ability to force new customers into waiting lists for Amazon Fresh and Whole Foods Market Delivery can also be understood as a reflection of its market power. Stout claims that “Amazon competes directly with Walmart and eBay” for merchants, but neglects to note that merchants who reserve inventory for Amazon’s rivals will be disappeared in Amazon’s search results. That’s a flex of market muscle, and it’s not available to Walmart or eBay. His insistence on indirect methods causes him to miss the forest for the trees.

Stout similarly claims that Yelp is a “vigorous competitor with Google in local search.” Yet he fails to reflect how Google can steer users to its own local search content (after appropriating or cloning content) via its control over the One Box and its search algorithm generally. This is not competition on the merits. It’s a rigged playing field that punishes edge innovators.

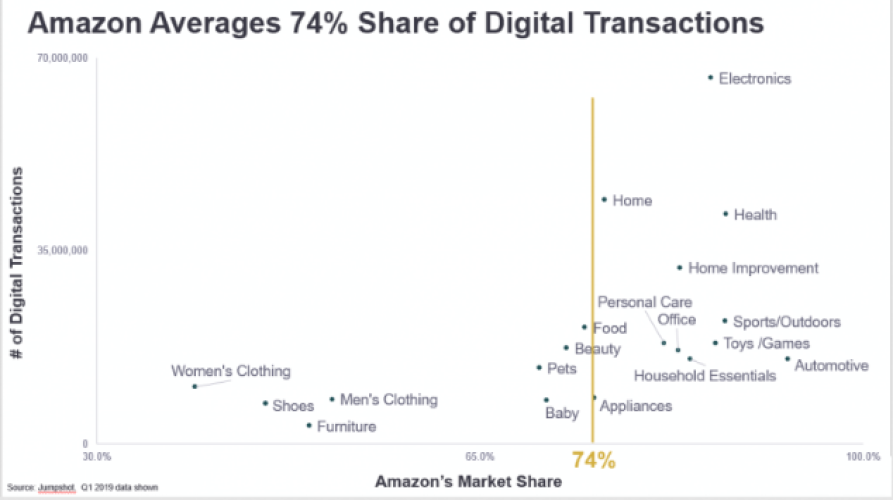

Insisting on defining relevant markets do not shield us from making incorrect inferences about a tech platform’s market power whenever market shares are estimated incorrectly. Amazon’s free-market defenders (and even “progressive” ones) are fond of comparing the gross merchandise value transacted on Amazon’s platform to all e-commerce in the United States, as estimated by the Census Bureau. But Census’s estimate includes several categories of e-commerce in which Amazon does not even compete. For example, Amazon does not sell cars online or second-hand products such as memorabilia. Amazon’s market share across all online commerce can be understood as a mix of Amazon’s share in the online markets in which it competes (call that S) and Amazon’s share in online markets in which it does not compete. We want S, not the weighted average of S and zero percent, which is downwardly biased. By one estimate from Jumpshot, within the products that it actually distributes, Amazon controls nearly three quarters of e-commerce sales.

Stout insists that Amazon competes in a larger retail market against brick-and-mortar providers, but even the Merger Guidelines contemplate price-discrimination markets, in which customers are distinguished by a certain attribute or channel. More generally, the Guidelines seek to identify the smallest set of products such that a hypothetical monopolist (or monopsonist) can exercise market power. Would Amazon, or even all e-commerce platforms, need to control brick-and-mortar outlets in order to push the price of an input below competitive levels? If not, then e-commerce constitutes a relevant market. The pandemic has made it painfully clear, if it wasn’t already, that brick-and-mortar outlets are weak substitutes to online delivery.

Divining Congressional Intent

Stout offers a nice history of how courts construed the Sherman Act’s intentions with respect to restraints of trade, from barring all restraints, to just those “naked” restraints in Addyston Pipe, to just “harmful” restraints in Standard Oil. Based on the language of the Act or its legislative history, however, Congress clearly did not intend to shield economically powerful actors from competition, nor enable restraints that harm one class of customers (merchants) because they might benefit another (cardholders). The antitrust laws, as interpreted today, likely would be unrecognizable to its original authors. That the DOJ has not brought a section 2 case in two decades feeds the belief the antimonopoly law has become a dead letter. And a 97 percent win rate for defendants in section 2 cases is equally absurd; any higher, and plaintiffs would not even bother even filing section 2 complaints.

However ill-conceived, Senator Klobuchar’s effort to bend exclusionary conduct law should be understood as a warning shot for the defenders of the status quo. She is not alone, as Senator Hawley is contemplating similar moves. Congress will soon make a cut. It can be surgical or it can be a gash. A clean way to address this demand for intervention is to reroute it towards sector-specific regulation. An alternative, and more aggressive approach would be to embrace Europe’s abuse-of-dominance standard, which polices exploitative acts by monopolists and entails a different burden regime. Pretending there is no competition problem in the tech sector, as Stout and the free-market fundamentalists are prone to do, could ironically hasten the demise of antitrust’s consumer-welfare standard.