How the Sausage Gets Made

The American Cow has taken up a striking amount of political news coverage recently. Far from condemning her for a myopic addiction to flatulation, politicians and bureaucrats alike are now bent on subsidizing her life, and more importantly, her death.

These political rumblings strike at the very core of American political economy. For years, American meat processing laws have restricted the workings of the free market, enabled the growth of an artificial oligopoly, and driven a stake through the breast of rural America. Moreover, this single political issue serves as a test case for an enduring problem—how to rectify the wrongs of an overweening bureaucracy.

Lawmakers on both sides of the aisle have joined to lobby for meat processing reform, led in recent years by Representative Dusty Johnson, the fiery-haired cattle crusader from South Dakota. The supply shocks of the COVID pandemic only added new members to the chorus.

The problem, simply put, is market consolidation among the nation’s meat processors. “We really don’t have a free market in the meat processing industry,” Johnson recently declared. Anytime the free market is claimed to fail, citizens should perk their ears in dismay. The data shows, however, that it is market interference that is the true cause of failure.

The Beginnings

In 1906, prompted by public outcry about filth-ridden big Chicago slaughterhouses, President Theodore Roosevelt signed the Federal Meat Inspection Act into law. The justification was that the free market had failed through private concealment of unsanitary meatpacking habits. The result was that USDA inspectors were now required to oversee the slaughtering of all meat (poultry excluded) destined for both interstate and international sale.

In 1967, Congress passed the Wholesome Meat Act, which extended the USDA’s jurisdiction and requirements to intrastate commerce. States had the option to inspect meat themselves, but their sanitation standards now had to be at least equal to those set by Washington, D.C., and no state-inspected meat could cross state lines. Initially, every state opted to keep its state service intact, although three state programs were ruled unequal and taken over by the USDA. A contemporary Congressional report stated that, despite the cost of keeping the state inspection program, “there are many who believe this is an appropriate area for state, rather than Federal, regulation,” and that “the states can administer the program more effectively.”

Today, 27 states still choose to operate their own inspection services, under federal guidelines. A host of rules and regulations has since been appended to these federal decrees. Starting in earnest in 1967 and continuing today, voices have argued that the stringency of this legislation has interposed regulative barriers to entry to the meat processing market. In 1972, a study recognized that the new law was hyper-focused on consumer health, and found that it cost meatpackers an average of $60,347 to conform to the new standards.

Economic study of regulatory barriers tells us that market consolidation is the usual result. And sure enough, USDA studies in 2000 and 2018 report that the meatpacking industry has been squeezed into a massive contraction since 1967. These regulations have resulted in an artificial oligopoly in the meat processing industry, with a mere four meatpackers controlling 80% of production.

Not a Natural Oligopoly

Now, an industry consolidation that leads to oligopolies is not always harmful. Natural economies of scale can occur for energy production or shipbuilding, where having only a few firms producing massive quantities leads to lower costs. In such industries, it can lead to somewhat beneficent consolidation. Meat, however, does not fall into this category, since the factors of production and the consumer market are both naturally diffuse. A cow-calf unit requires, on average, 1.5 acres of grass for rearing.

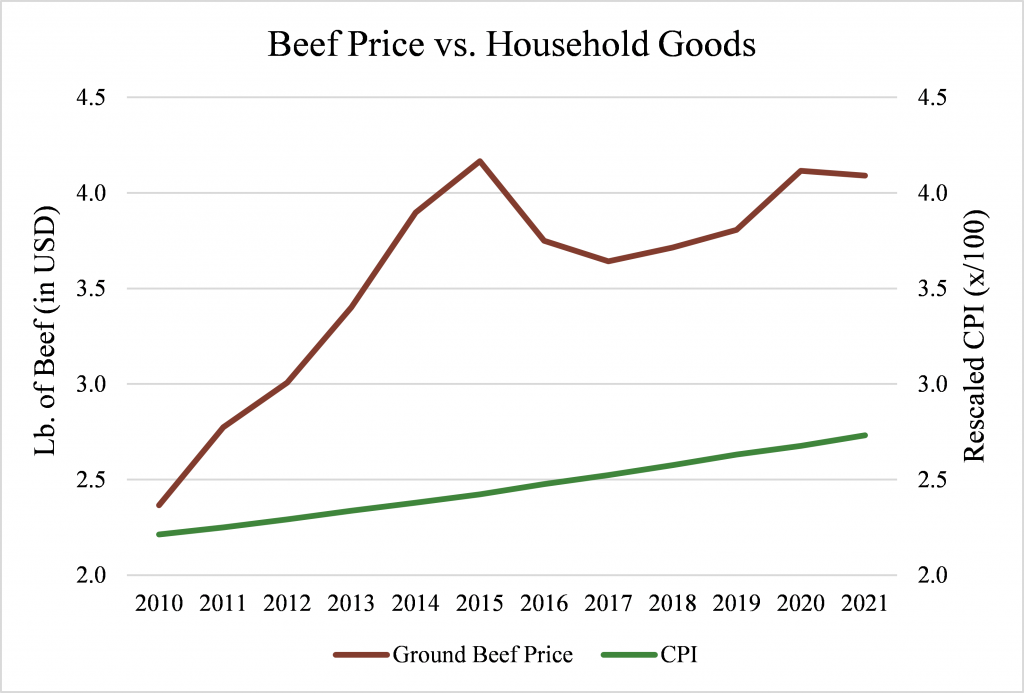

Studies indicate that consumers prefer locally-produced food: the more local the better. The consolidated market, however, rejects this consumer preference. This consolidation has not led to cheaper prices. Data shows that, since 1984, the price of ground beef has outpaced the rise in the Consumer Price Index (CPI) of other goods by an average of 0.07% every month. Moreover, as Figure 1 indicates, the rise in the price of beef has far outstripped inflation in both volatility and overall price in the past decade. Prices are going up, not down.

Figure 1: U.S. city average of beef price/lb. and rescaled CPI

The Economic Result

Given that livestock processing does not naturally yield itself to an oligopoly market, what does economic theory tell us are the risks of such a market? Having put ourselves in this position, could the benefits maybe outweigh the costs? It is unlikely. In 1945, Joseph Schumpeter wrote of the inefficiencies of oligopolies, observing that equilibrium in such markets, if achieved at all, “no longer guarantees either full employment or maximum output” compared to perfectly competitive sectors.

That is bad enough, but oligopolies are harmful for three other reasons. Each of these theoretical results has come to pass in the meat processing industry.

First, any consolidated industry is vulnerable to disasters. America has certainly seen this. A 2019 fire at a single Tyson plant in Kansas took out 5% of national processing capacity in one blow. A recent ransomware attack shut down production at all JBS plants in the country, cutting off 20% of processing for cattle and hogs. And of course, the recent pandemic wreaked havoc in the dense factories of the “big four” processors, with 13 shuttering for various lengths of time, slicing the nation’s pork processing capabilities by a whopping 25% for a time.

Secondly, oligopolies encourage cartel-like behavior. Sadly, this has again been the case. In fact, the Department of Justice is currently undergoing a probe into suspected collusion and market manipulation by the “big four” processors, even as the companies themselves have shelled out millions in collusion lawsuit settlements over the past few years.

Finally, oligopolies tend to limit the entrance and growth of new firms by lobbying for barriers to entry and welcoming the barriers when the government imposes them. As George Stigler expounds, licensing is a barrier most effectively established when an industry has a broad market, since “the costs which licensing imposes upon any one customer or industry will be small and it will not be economic for that customer or industry to combat the drive for licensure.” This is precisely the situation of the meat processing industry. The main regulatory culprit, the 1995 HACCP requirements, force processors to create individual plans for each cut of meat, at an average upfront cost of $13,540 per plan for small establishments. Each business must also create Sanitation Standard Operating Procedures (estimated at $21,102), Sampling Plans for testing (at a cost of $39,098), and regulatory compliance training for production employees (estimated at $2,297 apiece and over three times that for management). Thus, we see the formation of an artificial oligopoly, birthed by stringent federal legislation and giving rise to the prophesied shudderings of a consolidated market.

Studies indicate that consumers prefer locally-produced food: the more local the better. The consolidated market, however, rejects this consumer preference. This consolidation has not led to cheaper prices.

By constricting the market of meat processors, both local consumers and farmers have felt the pinch of lack of supply and higher prices. This is known as a bottleneck effect. Because of this bottleneck, there is a lack of local meat available to consumers. Due to a modern, efficiency-driven consolidation in grocery stores, the only option to buy local meat is often through a loophole in custom processing laws, where deep-pocketed customers can buy a quarter or a half of an animal and receive that proportion in meat upon its slaughter. It is a spotty and inefficient system.

On the producer side, this restriction is undoubtedly hindering rural entrepreneurship. A recent paper pinpointed the challenge: the independent, small to mid-sized farmer needs a processor small enough to handle custom batches of meat, but large enough to handle the regulatory compliance. These processors can be hard to find and far from the field, and thus, these small farmers have either quit selling independently or found a luxury, niche market. Tied with the economic bottleneck is a perversion of moral responsibility. By unfairly penalizing the small and entrepreneurial animal farmer, the federal government has kneecapped one of the few money-making ventures available to rural entrepreneurs.

The Solution

By now, three facts should be clear: a consolidation in meat processing has led to an oligopoly; this oligopoly is partially artificial due to regulation; and there is real economic harm from this circumstance. Two political approaches have thus been proposed. Philosophically broader than simply meat, these are strategies to deal with any overregulated market.

First, policy can try to remediate some of the ill effects of the market constriction. Given that the over-regulation has hindered supply, we should alleviate some of the damage to processors.

For instance, the USDA recently announced that they would be adopting two of Dusty Johnson’s proposed bills, allocating $500 million in grants and loans for new or expanding meat processors. In addition, $100 million in inspection relief is earmarked for small processors. It would be both truthful and charitable to acknowledge that this strategy works. It is a selective, exclusionary reduction of a regulatory burden that will likely improve the competitive landscape.

But to truly solve this government-provoked market problem, another tactic is needed: simply lower the barriers to entry themselves.

An excellent bipartisan bill, the PRIME Act, proposes this method. It seeks to return jurisdiction over processing to the states, as it was before federal usurpation of such in 1967. Like before, states could set their own processing regulations for intrastate sale. Politically, the PRIME Act represents a much-needed return to constitutional adherence. Economically, it could enable tailored and just solutions.

Instead of suffocating entrepreneurs in red tape, states could free small and local processors, acknowledging that their market and safety issues are distinct from those of hundred-acre slaughterhouses. Instead of tacitly endorsing market consolidation, states could permit vigorous and more competitive local markets to emerge for both producers and consumers. Instead of incentivizing environmental and cultural degradation, thoughtful animal husbandry could once again flourish.

A Fighting Chance

In 1972, a hearing on meat processing acknowledged “profound philosophical questions involving the proper role of government in the society, questions about which men have throughout history always tended to disagree.” When it came to the federal domination of the Wholesome Meat Act, such questions were “hardly raised.”

Perhaps it is time to raise them again now.

Do politicians really want to give rural America a chance to compete in the modern economy? If so, the answer is not necessarily to just throw money at their economic and social problems. Instead, deregulate the market to remove the artificial bottleneck. Return the power of choice to the consumer, and the ability to provide to the producer. And allow rural America to do what it does best: grow and sell the fruits of their labor.