Reforming Central Banks, Ordo-Liberal Style

It is the strangest of times for central banks. Traditionally, they have undertaken tasks like directing monetary policy, overseeing interbank payment systems, supervising commercial banks, issuing currency, managing government bonds and gold and foreign-exchange reserves, and acting as lender of last resort during financial crises. Now, however, institutions like the Federal Reserve and the European Central Bank are busy affirming their willingness to “green the financial system” and diminish economic inequality, among other things.

On one level, this indicates that many contemporary central bankers aren’t especially immune to the lures of the latest cause célèbre. But it also suggests that many central bankers consider themselves obliged to mimic the wider agenda of the government of the day, even if that agenda’s particulars have little to do with a central bank’s most basic remits.

Such activism is invariably rationalized by reference to central banks’ responsibility to prevent systemic risk from building up in financial systems. Systematic risk, however, is traditionally understood to be concerned with ensuring that the banking system is sufficiently capitalized. Climate change doesn’t fall into that category. Moreover, political and economic responsibility for such matters belongs to legislatures and governments, not central banks. Putting central banks back in their box is thus not only about refocusing their attention upon their core mission. It also concerns reaffirming who is properly responsible for what—a sine qua non for institutional accountability in liberal constitutional politics.

The Limits of Independence

The truth is that legislators and governments have long pushed central banks to look beyond the realm of money and financial markets. That owes something to neo-Keynesian ideas about pump-priming the economy in an effort to guarantee full employment, but also to governments’ and legislators’ reluctance to do their job. As the German ordo-liberal economist Wilhelm Röpke often noted, why should politicians undertake necessary but unpopular tasks like cutting spending in real terms or tackling structural rigidities in the economy when they can lean on pliant central banks to engage in continuous credit expansion and pursue cheap money policies? For governments, the political benefits of short-term gain would always outweigh such policies’ long-term economic negativities.

Central bank independence—whether consisting of legal guarantees of protection from political interference; or the freedom to set its own goals; or the liberty to decide how best to achieve its mandated objectives; or security of tenure for senior officials—is supposed to guard against such pressures. But as Peter J. Boettke, Alexander Salter, and Daniel J. Smith observe in Money and The Rule of Law (2021), “Despite the appearance of formal independence from politicians, there are many ways political pressure can be and is brought to bear on monetary policy decision-makers.” Whether it is through appointing like-minded people to central bank boards, or threatening to alter a central bank’s brief through legislation, political leaders have many ways to bring erstwhile monetary hawks to heel.

In this light, present efforts to push central banks into pursuing politically chic goals simply represent an extension of an ongoing problem. It happens to be one that attracted considerable attention in the 1940s and 1950s from a group of free market thinkers with an especially strong interest in sound money. Permanently scarred by the hyperinflation which had wreaked havoc in Central Europe in the 1920s, European ordo-liberals were determined to find ways to cement in place a commitment to price stability capable of resisting the political class’s perpetual short-termism.

Getting Rules Right

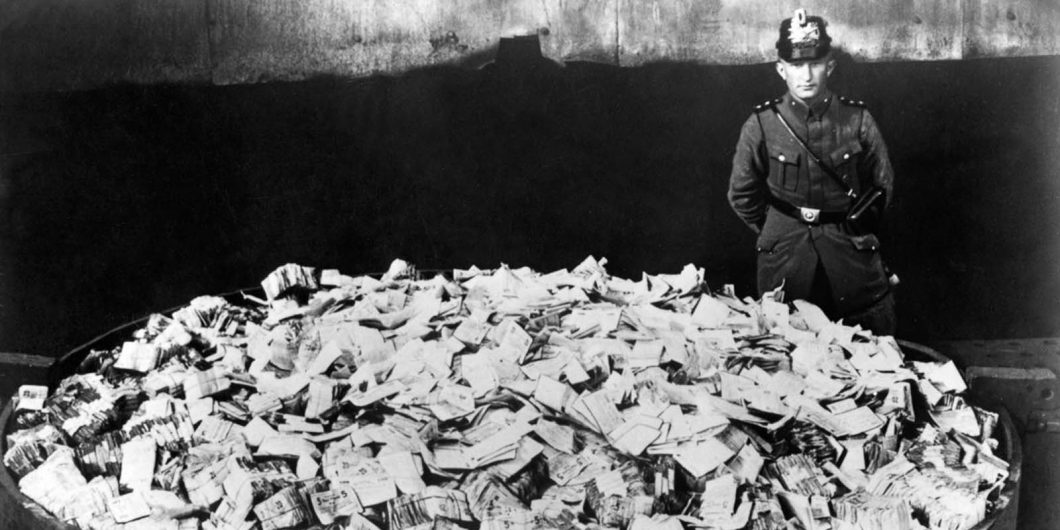

It’s difficult to underestimate the political and psychological impact of the inflation that ravaged countries like Germany and Austria in the early 1920s. Much of the middle-class in these and other countries experienced the shock and humiliation of their savings being rendered worthless.

This sensitivity about inflation was exacerbated by the Nazi regime’s use of stimulus programs to address unemployment and re-arm its military in the 1930s, followed by the deployment of outright inflationary policies to fund Germany’s war effort between 1939 and 1945. During World War II, wage and price controls were implemented to try and repress the German economy’s natural reactions to the inflationary impact of unending state-initiated credit expansion. The end result was a crippling of money’s ability to signal the real price of goods and services. This problem was only resolved in 1948 via the abolition of such controls and the introduction of a new currency to replace the discredited Reichsmark.

The intellectual impetus for those reforms came from ordo-liberal thinkers like Röpke and Walter Eucken. They also devoted considerable thought to how to insulate the business of creating and restricting credit from the machinations of political leaders whose horizons were generally limited to the electoral cycle or whatever they deemed an immediate need. What emerged from these reflections were two sets of recommendations. The first was focused on rules; the second concerned questions of morality and character.

Central banks have for the most part acquiesced in the ongoing blurring of the line between monetary and fiscal policy, and allowed themselves to be dragged into policy realms that are not part of their responsibilities.

Ordo-liberalism is known for its stress upon the economic significance of law, institutions, and constitutions. This was central to Eucken’s insistence that the monetary order “should be based on strict rules” and function “as automatically as possible.” By this, Eucken had in mind something like the classic gold standard that operated between the 1870s and 1914, or, alternatively, constitutionally-grounded rules that restricted the central bank’s mandate to the maintenance of price stability.

In effect, Eucken wanted to put questions of monetary order beyond the influence of economically uninformed public opinion, rent-seeking interest groups, and politicians looking to abuse monetary policy to avoid making hard decisions. Eucken considered this far preferable to granting independence to central banks, not least because he thought that the track record of most central bankers in the 1920s and 1930s underscored that one could have little confidence in their judgment. Central bank independence, he believed, would only insulate them from correction.

Eucken’s approach to monetary order reflected the influence of Kantian ethics’ emphasis on categorical imperatives as well as his experiences of the 1920s and 1930s. After Eucken’s early death in 1950, this message continued to be articulated by Eucken’s most important student, the economist Friedrich Lutz, as well as highly influential figures like the ordo-liberal postwar president of the state central bank of Hesse, Otto Veit. They wanted no deviation from the goal of reducing and limiting inflation.

Character Questions

This, however, was not the full story. Many ordo-liberals were convinced that past monetary policy failures also reflected some major character failures by central bankers. Certainly, they agreed with Lutz and Veit about the importance of rules and worked to ensure that the postwar German Bundesbank’s legislatively determined mission of “safeguarding the currency” was interpreted as a commitment to price stability. But they also maintained that central banks needed to be led and staffed by people who understood the moral stakes involved in upholding monetary order.

One lesson that many ordo-liberal economists and German central bankers drew from the 1920s, 1930s, and 1940s was that money was not only a mechanism by which one measured prices. It also needed to be understood as central to the moral health of the wider social and economic order. This was the ethical basis upon which central bankers had to ground their resistance to efforts by governments to divert monetary policy away from the imperative of price stability.

Commitment to this ideal was expressed in the Bundesbank’s conscious cultivation of an internal culture in which its leaders and staff were expected to possess not only technical expertise but also unquestioned integrity, intellectual independence, and, in a word, virtue. Figures like Hans Tietmeyer, the conservative Catholic ordo-liberal economist who led the Bundesbank between 1993 and 1999, personified this model. Adherence to monetary rules was certainly important, but so too, he believed, was moral toughness. This was reflected in Tietmeyer’s emphasis upon reason, duty, frugality, hard work, and discipline whenever he discussed monetary policy or broader economic issues. Tietmeyer was not a monetary dogmatist, but he insisted that central banks required the inner fortitude to say “no” whenever pressured to do what they should not.

This was accompanied by recognition of the need to explain to the wider public why price stability was so important for economic and social order. This is not something that central banks typically do, perhaps because many central bankers today seem imprisoned in the language of mathematical formalism. The difference in Germany in the 1950s and 1960s was that there were millions of people still alive who had experienced hyperinflation and understood what happens when price stability is compromised.

Bundesbank officials subsequently wrote essays for newspapers and gave speeches directed at audiences far beyond the economics profession in which they stressed why price stability mattered. They did not believe that most German politicians could be relied upon to educate the citizenry about these matters. Their efforts were complemented by ordo-liberal scholars like Röpke who hammered away at the moral and economic importance of price stability in long articles published in quality and popular German newspapers during the same time period.

Back to Basics, Legal and Moral

The long-term fruits of these efforts can be seen in the aversion even today of large segments of German public opinion to dovish views of inflation, the Bundesbank’s willingness to criticize German governments when it believes serious economic errors are being made, and its reputation as a price stability hardliner on the ECB board. This suggests that a particular mindset about money’s moral significance became rooted in German political and popular culture.

Such attitudes are, however, not the norm in most central banks in our time. Far from explaining why a focus on price stability represents a commitment to money as a moral anchor for society, contemporary central bank presidents can hardly bring themselves to say anything critical about the obscene levels of debt-fueled public spending that were becoming the norm through Western economies long before COVID. Indeed, central banks have for the most part acquiesced in the ongoing blurring of the line between monetary and fiscal policy, allowed themselves to be dragged into policy realms that are not part of their responsibilities, and left many wondering if central bank independence means anything at all today.

The good news is that it doesn’t have to be this way. But that will require rethinking the political and legal framework in which central banks operate while simultaneously infusing them with a sense of moral purpose that’s different from the sentimental humanitarian pieties that dominate public discourse today. Those looking to get America’s monetary policy house in order could do worse than reflect upon how ordo-liberals engaged precisely these types of issues at a time when, for most people, monetary order had not been the norm.