Causes of the Great Depression

About every ten years or so, financial crises spoil economic hopes and many best-laid plans. As scary as they are while happening, like everything else, in time, they tend to fade from memory. For example, can you recall the remarkable number of US depository institutions that failed in the crisis of the 1980s? (The correct answer: More than 2,800!)

The weakness of financial memory is one reason for recurring over-optimism, financial fragility, and new crises. But the Great Depression of the 1930s is an exception. It was such a searing experience that it retains its hold on economic thought almost a century after it began and more than 90 years after its US trough in 1933. That year featured the temporary shutdown of the entire US banking system and an unemployment rate as high as 24.9 percent. More than 9,000 US banks failed from 1929–33. Huge numbers of home and farm mortgages were in default, and 37 cities and three states defaulted on their debt. How could all this happen? That is still an essential question, with competing answers.

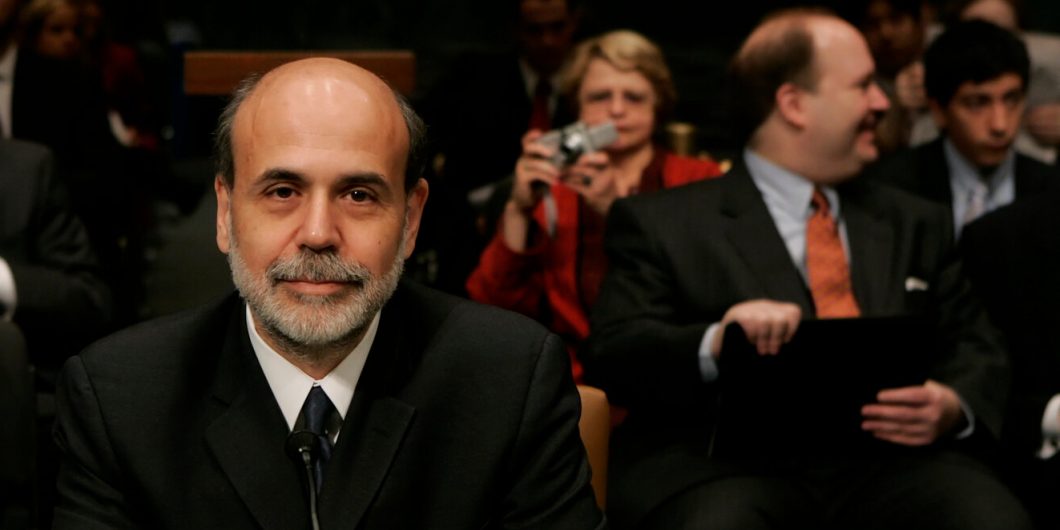

This collection of Ben Bernanke’s scholarly articles on the economics of the Depression was originally published in 2000. That was two years before he became a Governor on the Federal Reserve Board, and seven years before, as Federal Reserve Chairman, he played a starring world role in the Great (or Global) Financial Crisis of 2007–09 and its aftermath, always cited as “the worst financial crisis since the Great Depression.”

Bernanke’s Essays on the Great Depression has now been republished, with the addition of his Lecture, “Banking, Credit and Economic Fluctuations,” delivered upon winning the Nobel Prize in Economics in 2022. They make an interesting, if dense and academic, read.

“To understand the Great Depression is the Holy Grail of macroeconomics,” is the first line of the first article of this collection. “Not only did the Depression give birth to macroeconomics as a distinct field of study, but … the worldwide economic collapse of the 1930s remains a fascinating intellectual challenge.” Indeed it does.

Bernanke points out that “no account of the Great Depression would be complete without an explanation of the worldwide nature of the event.” As one example of this, we may note that Germany was then the second largest economy in the world, and “the collapse of the biggest German banks in July 1931 represents an essential element in the history,” as a study of that year relates. Germany was at the center of ongoing disputes about the attempted financial settlements of the Great War (or as we say, World War I). Widespread defaults on the intergovernmental debts resulting from the war also marked the early 1930s.

“What produced the world depression of 1929 and why was it so widespread, so deep, so long?” similarly asked the eminent financial historian, Charles Kindleberger. “Was it caused by real or monetary factors?” Was it “a consequence of deliberate and misguided monetary policy on the part of the US Federal Reserve Board, or were its origins complex and international, involving both financial and real factors?”

“Explaining the depth, persistence, and global scope of the Great Depression,” Bernanke reflects in his 2022 Lecture, “continues to challenge macroeconomists.” Although he concludes that “much progress has been made,” still, after nearly a century, things remain debatable. This calls into question how much science there is in economics looking backward, just as the poor record of economic forecasting questions whether there is much science in its attempts to look forward.

In economics, it seems, we can’t know the future, we are confused by the present, and we can’t agree on the past. Those living during the Depression were confused by their situation, just as we are now by ours. As Bernanke writes, “The evidence overall supports the view that the deflation was largely unanticipated, and indeed that forecasters and businesspeople in the early 1930s remained optimistic that recovery and the end of deflation were imminent.”

In Lessons from the Great Depression, a 1989 book that Bernanke often references, Peter Temin provides this wise perspective: “We therefore should be humble in our approach to macroeconomic policy. The economic authorities of the late 1920s had no doubt that their model of the economy was correct”—as they headed into deep disaster. “It is not given to us to know how future generations will understand the economic relations that govern how we live. We should strive to be open to alternative interpretations.”

Bernanke considers at length two alternative causes of the Depression and through his work adds a third.

The first is the famous Monetarist explanation of Federal Reserve culpability, referred to by Kindleberger, derived from the celebrated Monetary History of the United States by Milton Friedman and Anna Schwartz. Friedman and Schwartz, writes Bernanke, “saw the response of the Federal Reserve as perverse, or at least inadequate. In their view, the Fed could have ameliorated the deflationary pressures of the early 1930s through sustained monetary expansion but chose not to.” About this theory, Bernanke says, “I find it persuasive in many respects.” However, “it is difficult to defend the strict monetarist view that declines in the money stock were the only reason for the Depression, although … monetary forces were a contributing factor.” It seems eminently reasonable that multiple causes were at work to cause such a stupendously disastrous outcome.

“The Germans kept wages low and reached full employment quickly; the Americans raised wages and had to cope with continued unemployment.”

A second approach takes as central to the depth of the Depression the effects of governments’ clinging too long to the Gold Exchange Standard. That was the revised version of the gold standard that was put together in the 1920s as the world tried to return to something like the pre-Great War monetary system, which previously had accompanied such impressive advances in economic growth and prosperity. The Classic Gold Standard was destroyed by the Great War, as governments bankrupted themselves, then printed the money to spend on the war’s vast destruction and set off the rampant inflations and hyper-inflations that followed.

After the inflations, there was no simple going back to the monetary status quo ante bellum. However, “the gold standard [was] laboriously reconstructed after the war,” Bernanke relates, referring to the Gold Exchange Standard. “By 1929 the gold standard was virtually universal among market economies. … The reconstruction of the gold standard was hailed as a major diplomatic achievement, an essential step toward restoring monetary and financial conditions—which were turbulent during the 1920s—to … relative tranquility.”

Financial history is full of ironies. Here we had a “major diplomatic achievement” in global finance by intelligent and well-intentioned experts. But “instead of a new era of tranquility,” Bernanke tells us, “by 1931 financial panics and exchange rate crises were rampant, and a majority of countries left gold in that year. A complete collapse of the system occurred in 1936.” The United States left the gold standard in 1933.

Bernanke highlights the comparative studies of countries during the 1930s which found a notable pattern of “clear divergence”: “the gold standard countries suffered substantially more severe contractions,” and “countries leaving gold recovered substantially more rapidly and vigorously than those who did not,” and “the defense of gold standard parities added to the deflationary pressure.” Thus, he concludes, “the evidence that monetary shocks played a major role in the Great Contraction, and that these shocks were transmitted around the world primarily through the working of the gold standard, is quite compelling.”

So far, we have an explanatory mix of the behavior of central banks faced with huge shocks in the context of the revised Gold Exchange Standard in the aftermath of the runaway inflations stemming from the Great War.

In addition, Bernanke’s own work emphasizes the role of credit contractions, not just monetary contractions, with a focus on “the disruptive effect of deflation on the financial system”—or in macroeconomic terms, “an important role for financial crises—particularly banking panics—in explaining the link between falling prices and falling output.” Bernanke provides a depressing list of banking crises around the world from 1921 to 1936. This list is nearly four pages long.

Bernanke concludes that “banking panics had an independent macroeconomic effect” and that “stressed credit markets helped drive declines in output and employment during the Depression.” This seems easily believable.

Bernanke’s articles also address employment during the Depression. Although economic conditions significantly improved after 1933, unemployment remained remarkably, perhaps amazingly, high. Continuing through all of the 1930s, it was far worse than in any of the US financial and economic crises since. At the end of 1939, US unemployment was 17.2 percent. At the end of 1940, after two full presidential terms for Franklin Roosevelt and the New Deal, unemployment was still 14.6 percent. Very high unemployment lasted a very long time.

The Depression-era interventions of both the Hoover and the Roosevelt administrations focused on maintaining high real wages. As Bernanke writes, “The New Deal era was a period of general economic growth, set back only by the 1937–38 recession. This economic growth occurred simultaneously with a real wage “push” engineered in part by the government and the unions.” But “how can these two developments be consistent?” Well, economic growth from a low level with a government push for high real wages was accompanied by high and continued unemployment. That doesn’t seem like a surprise.

The New Deal real wage push continued what had begun with President Hoover. The Austrian School economist, Murray Rothbard, says of Hoover in the early Depression years, “No one could accuse him of being slack in inaugurating the vast interventionist program.” He quotes Hoover’s statement in 1932 that wage rates “were maintained until the cost of living had decreased and profits had practically vanished. They are now the highest real wages in the world.” Rothbard rhetorically asks, as we might ask of the 1930s in general, “But was there any causal link between this fact and the highest unemployment rate in American history?” As Temin observes about the 1930s, “the Germans kept wages low and reached full employment quickly; the Americans raised wages and had to cope with continued unemployment.”

Turning to a more general perspective on the source of the Depression, Rothbard observes that “many writers have seen the roots of the Great Depression in the inflation of World War I and of the postwar years.”

Yet more broadly, it has long seemed to me that in addition to the interconnected monetary and credit problems carefully explored in Bernanke’s book, the most fundamental source of the Depression was the Great War itself, and the immense shocks of all kinds created by the destruction it wreaked—destruction of life, of wealth, in economics, in finance, of the Classic Gold Standard, of currencies, in the creation of immense and unpayable debts, and the destruction of political and social structures, of morale, of pre-1914 European civilization.

As Temin asks and answers, “What was the shock that set the system in motion? The shock, I want to argue, was the First World War.”

And giving Bernanke’s Nobel Prize Lecture the last word, “In the case of the Depression, the ultimate source of the losses was the economic and financial damage caused by World War I.”