How to Recapitalize the Federal Reserve

The Federal Reserve starts the new year with capital, properly accounted for, of negative $92 billion. How can that be? How can the world’s greatest central bank, the issuer of the world’s dominant reserve currency, be technically insolvent—and by such a huge number?

The answer is that the Fed has accumulated immense operating losses, which by January 3, 2024, totaled $135 billion. Since September 2022, the Fed has been paying out more in interest expense to finance its more than $7 trillion securities portfolio than it receives in interest income. The losses continue into 2024 at the rate of over $2 billion a week. When you subtract the Fed’s accumulated losses, which are real cash losses, from the Fed’s stated capital of $43 billion, you get the Fed’s true consolidated capital, that is: $43 billion in starting capital minus $135 billion in losses equals the current capital of negative $92 billion. This balance sheet math is straightforward and unassailable under generally accepted accounting principles (GAAP).

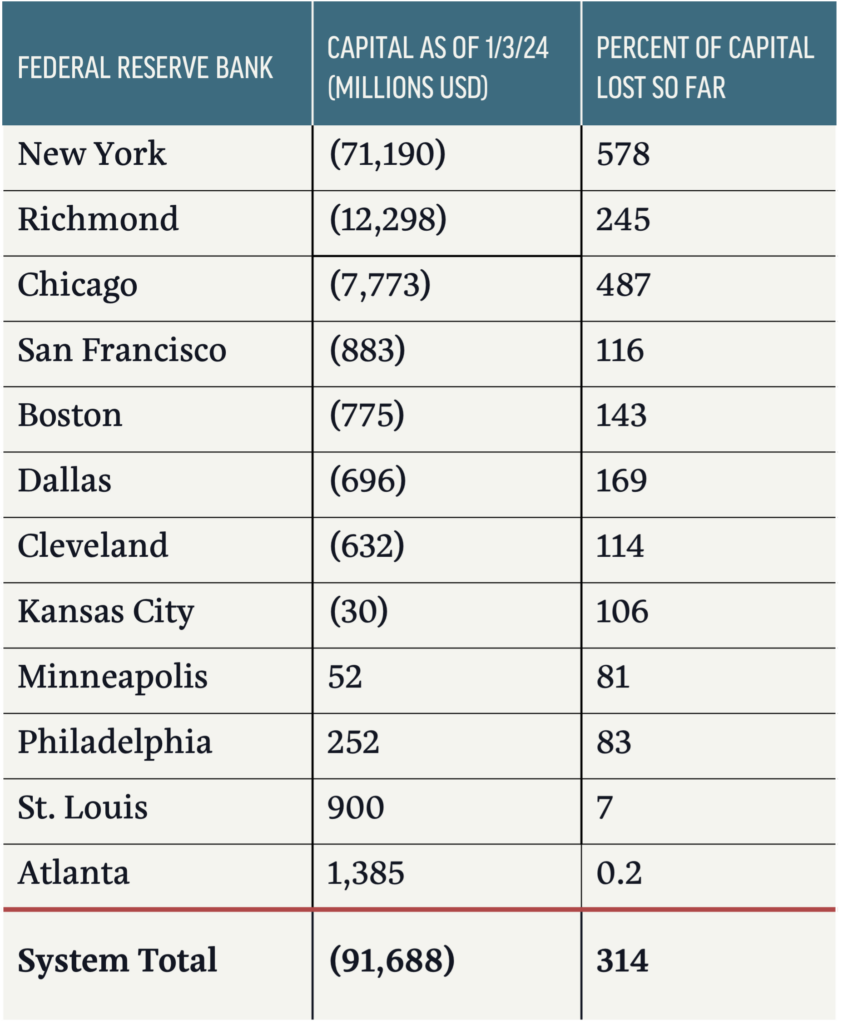

The Federal Reserve System includes 12 regional Federal Reserve Banks (FRBs), each one a separate corporation with its own shareholders, customers, and balance sheet. Considered on their own, with proper accounting, 8 of the 12 FRBs start 2024 with negative capital. This means their accumulated cash operating losses exceed 100% of their capital. Two others have lost more than 80% of their capital and will exhaust their capital in 2024. Only two FRBs have their capital intact. Their operating losses have been limited because these banks have an especially high proportion of their funding supplied by the paper currency (Federal Reserve Notes) they issue—currency does not pay interest and thus results in lower overall interest expense. Under commercial bank rules, 10 of the 12 FRBs would be classified as severely undercapitalized, as would the entire consolidated Federal Reserve System. As of January 3, 2024, the FRBs true capital numbers are:

At the current rate the Fed is losing money, its negative capital will exceed $100 billion by February 2024.

You will not find the Fed’s true capital position reported on the Fed’s official consolidated balance sheet or on the individual FRBs’ balance sheets. This is because the Fed—unbelievably—does not subtract its losses from its retained earnings. Instead, it pretends that its growing losses are an asset. “Ridiculous!” you may exclaim. The kindest way to describe this Fed accounting is that it is non-standard, but Congress has allowed the Federal Reserve to determine its own accounting rules. Since its accumulated operating losses have made the actual liabilities of the Fed larger than its assets, the Fed created a new “asset” because it doesn’t want to show that it has negative capital. We do not suggest you try this accounting sleight-of-hand if you are a private bank, a business, or filling out a home loan application.

The Fed claims that, even if it does have negative capital, it doesn’t matter because it can always print all the money it needs. However, there are, in fact, limits to its ability to print paper currency. But even if there were no limits, the Fed’s large negative capital, growing ever more negative each week, certainly makes the Fed look bad—incompetent even—and calls its credibility into question. While it is not widely understood, the deposits in FRBs are unsecured liabilities of each individual FRB. When an FRB has negative capital, the presumed risk-free status of its deposits hinges on a belief that the deposits are implicitly guaranteed by the US Treasury.

Maintaining market confidence in the Federal Reserve System and FRBs is critical. As the Fed’s losses continue to rapidly accumulate, it would be sensible for Congress to recapitalize the Fed and bring it back to positive capital with assets greater than, instead of less than, its liabilities, and restore it to technical solvency. This could be done with four steps, which would fit well with and expand Pollock’s proposals for Reforming the Federal Reserve:

- Suspend FRB dividends

- Exercise the Fed’s existing capital call on its stockholders

- Assess the stockholders to offset Fed losses, as provided in the Federal Reserve Act (FRA)

- Have the US Treasury buy stock in the Federal Reserve, consistent with the original FRA.

Suspend Dividends

When banks or any other corporations are suffering huge losses, especially if they have negative retained earnings, let alone negative total capital, a typical and sensible reaction is to stop paying dividends. Indeed, the Federal Reserve in its role as a bank regulator would insist on this for the banks and holding companies it regulates. The same logic should apply to the Fed itself. The central bank of Switzerland is an instructive example. Like the Fed, the Swiss National Bank is now facing losses but, unlike the Fed, it still has significant positive capital. Nonetheless, the Swiss National Bank has stopped paying dividends for the last two years. When the Fed is losing over $100 billion per year, there is scant justification for it to be paying $1.5 billion in dividends to its member bank shareholders annually.

However, to stop a technically insolvent Fed from paying dividends, Congress has to get involved and amend the Federal Reserve Act. The FRA currently provides that the Fed’s dividends are cumulative. This provision reflects the former belief that the Fed would always make profits. With today’s reality of massive losses, the Federal Reserve Act should be revised to make dividends noncumulative and to prohibit FRB dividend payments if such payments would result in negative retained earnings (“surplus” in Fed terminology) on a GAAP basis.

Exercise the Fed’s Existing Capital Call on its Stockholders

Section 2.3 of the Federal Reserve Act requires every bank that is a member of a Federal Reserve Bank to subscribe to shares of the FRB in an amount tied to the member bank’s own capital. The member-stockholders, however, are required to pay in and have paid in only half of the amount subscribed. The other half is subject to call by the Federal Reserve Board, and if called, must be paid in by the member bank.

The total paid-in capital of the Fed is $36 billion. An additional $36 billion in FRB capital could be raised if the Federal Reserve Board simply exercised its existing statutory call. This would reduce the Fed’s negative capital as of January 3, 2024, by 39%. If the Federal Reserve Board balks at exercising the capital call, Congress should instruct it to do so.

Under our recommended changes to Fed dividend policy, the newly paid-in shares would not receive dividends until FRBs return to positive GAAP retained earnings (“surplus”).

Assess the Stockholders to Offset Fed Losses, as Provided for in the Federal Reserve Act

In a very little-known but very important provision of the FRA, which goes back to its original 1913 enactment, Federal Reserve Bank shareholders are made liable in addition to their subscription to Fed stock, for another amount equal to that subscription, which they may be assessed to cover all obligations of their FRB; in other words, to offset negative capital. A member bank assessment would be a cash contribution to their FRB, not an investment in more stock. Says the FRA, “The shareholders of every Federal reserve bank shall be held individually responsible … to the extent of the amount of their subscriptions to such stock at the par value thereof in addition to the amount subscribed.” (Italics added.)

The total subscriptions to Fed stock are twice the outstanding paid-in capital of $36 billion, so the subscriptions total $72 billion, and the maximum possible assessment on the Fed member banks is thus $72 billion. Since two FRBs, Atlanta and St. Louis, still have their capital intact, the available assessment would be on the other ten FRBs. The maximum assessments would be these FRBs’ paid-in capital of $34 billion times 2, or $68 billion. By comparison, the Fed paid $177 billion in interest and dividends to its member banks in 2023.

The original Federal Reserve Act, as enacted in 1913, provided for the US Treasury to buy Federal Reserve Bank stock, if necessary.

With the maximum assessment on the members of these ten FRBs in addition to calling the unpaid half of the stock subscriptions for all the FRBs, the total raised would be $104 billion ($36 billion in new stock plus $68 billion in assessments). This amount would offset the Fed’s year-end capital deficit of $92 billion and would cover about six weeks of additional losses at the current rate of $2 billion a week.

Doubtless the Fed’s member banks would be exceedingly unhappy with these actions to shore up the capital of the Federal Reserve. But member banks, as the sole shareholders in the FRBs, have a clear statutory obligation to financially support FRBs that will soon have consolidated true negative capital in excess of $100 billion.

Judging by public financial statements disclosures, few—if any—Fed member banks have seriously considered the large statutory contingent liability that membership in the Fed brings. Taking into account FRBs’ financial condition and their shareholders’ clear legal obligations, it seems that FRB member banks should be disclosing this material contingent liability.

Have the US Treasury Buy Stock in the Federal Reserve, Consistent with the Original Federal Reserve Act

Suspending FRB dividends, calling the rest of the member banks’ stock subscriptions, and assessing FRB stockholders the maximum amount would make the Fed’s capital positive again until mid-February 2024. After that, continuing losses will put it back into negative territory and the Fed back into technical insolvency. Given the fact that the Fed is stuck with long-term fixed-rate investments yielding a mere 2%, and that $3.9 trillion of its investments have more than ten years left to maturity, the Fed’s very large cash losses will most likely continue for quite a while.

Another source of recapitalization is needed.

The original FRA as enacted in 1913 provided for the US Treasury to buy Federal Reserve Bank stock, if necessary. (It also provided for possible sale of FRB stock to the public, which did not happen and could not happen under today’s circumstances.) Section 2.10 of the FRA, which has never been amended, empowers an FRB to issue shares to the Treasury to raise needed capital:

Should the total subscriptions … to the stock of said Federal reserve banks, or any one or more of them, be, in the judgment of the organization committee [the Secretary of Treasury, the Secretary of Agriculture, the Comptroller of the Currency], insufficient to provide the capital required therefor, then and in that event the said organization committee shall allot to the United States such an amount of said stock as said committee shall determine. Said United States stock shall be paid for at par out of any money in the Treasury not otherwise appropriated, and shall be held by the Secretary of the Treasury, and be disposed of… as the Secretary of the Treasury shall determine.

In a 1941 opinion, the Federal Reserve Board argued: “As originally enacted, the Federal Reserve Act provided for a Reserve Bank Organization Committee … [and] was authorized to allot Federal Reserve Bank stock to the United States in the event that subscriptions to such stock … were inadequate. However, subscriptions by member banks were adequate. … Accordingly, [this section] is now of no practical effect.”

However, the Fed’s financial condition has dramatically changed since 1941. In 2024, the subscriptions to the capital of the FRBs are grossly inadequate—the FRBs cannot maintain positive capital. Allocation of Fed stock to the United States would now be of very significant practical effect.

In light of the Fed’s technical insolvency, ongoing huge losses, and massively negative capital, Congress could sensibly amend Section 2.10 to read as follows:

Should the total subscriptions to the stock of the Federal reserve banks and the further assessments of the shareholders be insufficient to maintain positive capital as measured by GAAP for any one or more of the Federal reserve banks, then the Board of Governors of the Federal Reserve shall allot to the United States such an amount of said stock as the Board shall determine will bring the capital as measured by GAAP of these Federal reserve banks to not less than $100 million and maintain the consolidated capital of the Federal Reserve System as measured by GAAP at not less than $1.2 billion. The United States stock shall be paid for at par out of any money in the Treasury not otherwise appropriated and shall be held by the Secretary of the Treasury. Said stock may be repurchased at par by a Federal reserve bank or banks at any time, provided that after the repurchase, the capital of each Federal reserve bank as measured by GAAP shall be not less than $100 million and that the consolidated capital of the Federal Reserve System as measured by GAAP shall be not less than $1.2 billion.

The stock purchased by the Treasury would be non-voting, since the FRA provides that “Stock not held by member banks shall not be entitled to voting power.”

If over the next 15 months the Fed loses the same $135 billion as it has in the last 15 months, the Treasury would own about $123 billion in par value of FRB stock by March 31, 2025, and the member banks would own $72 billion after the capital call. The Treasury would thus own about 62% of the consolidated Fed stock but could not vote its shares. Over the long-term future, the FRBs would repurchase the Treasury’s shares as their finances permit.

With these four steps, the recapitalization of the Federal Reserve would be complete. Our proposed consolidated capital of $1.2 billion compared to the Fed’s beginning of 2024 total assets of $7.7 trillion, would give the Fed a leverage capital ratio of 0.016%—small indeed, but always positive. In other words, this revised section of the Federal Reserve Act would mean that the Treasury would, as it does for Fannie Mae and Freddie Mac, ensure that over time, the most important central bank in the world would never again be technically insolvent, no matter how big its losses.