Fed leadership has not produced the positive, stable results promised.

Milei's Policy Challenges

Argentina welcomes a new president. Defying poll predictions of a technical tie, the anarcho-capitalist candidate Javier Milei achieved a resounding victory over Peronist Sergio Massa in the runoff by a wide margin. The unexpected turn of events led to Massa conceding defeat even before the official results were announced, surprising many observers.

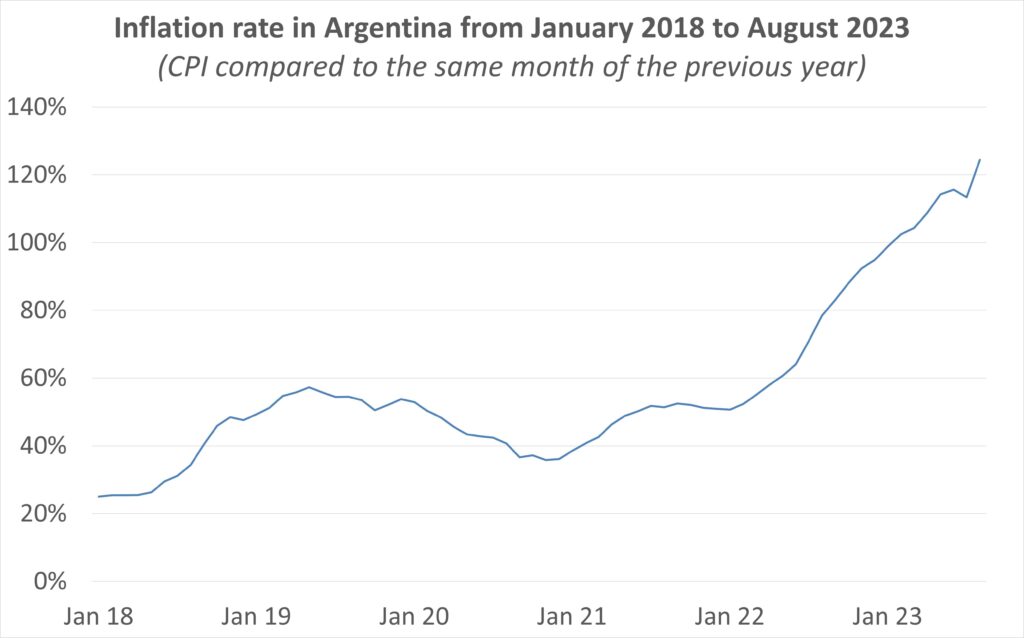

As the president-elect, Milei will confront four immediate economic challenges: addressing inflation, curbing the fiscal deficit, eliminating regulatory hurdles that hinder the growth of the Argentine economy, and tackling elevated poverty rates. The most pressing concern is the looming risk of hyperinflation. Inflation has plagued Argentina for decades, constituting an enduring economic ailment. From 1980 to 2022, the nation experienced an average inflation rate of 206%. Over the last twelve months, prices surged by a staggering 143%.

Milei’s plan to tackle inflation hinges on the radical step of dismantling Argentina’s central bank (BCRA) and embracing the US dollar as the nation’s official currency. This proposition has sparked fervent debate, evident in the strong resistance it faces from politicians across the political spectrum and prominent academics. Nonetheless, there is a widespread acknowledgment that decisive action must be taken to confront the nation’s foremost economic challenge. Does dollarization represent the optimal strategy to set the nation on a path toward monetary stability?

There is no straightforward answer. Dollarization is not the first best choice, as it deprives central banks of the monetary policy tools they typically employ to address economic crises. For instance, in the face of deflationary pressures, a central bank would typically reduce the policy rates to stimulate economic activity. In a dollarized economy, the national central bank is either eliminated (as Milei proposes) or loses its authority over monetary policy, leaving policymakers with fewer resources to use in the event of a crisis.

Furthermore, the elimination of the BCRA implies the loss of its role as a lender of last resort to address liquidity issues within the banking sector, especially during financial crises. Likewise, the process of dollarization demands an ample supply of dollar reserves, and the BCRA has notably reduced its holdings over the past year. This reduction in reserves could potentially introduce complications in the dollarization process. The question then arises: are these challenges insurmountable?

Undoubtedly, the ideal stance for a country or a group of countries is to uphold monetary policy autonomy. However, the effectiveness of such a policy hinges on the existence of an independent central bank endowed with the capacity to promote price stability through judicious monetary measures. This stands in contrast to the BCRA, which has demonstrated a dismal track record in controlling inflation, as evidenced by the recurring inflationary episodes over the past decades.

A less radical course of action could involve retaining the peso while endowing the BCRA with independence from political interference, thereby curbing its tendency to monetize government debt. Regrettably, this option might be hindered by the BCRA’s lack of credibility and the historical inability of politicians over the past decades to effectively address and control inflation by granting independence to Argentina’s central bank.

Can the banking system survive without a central bank injecting liquidity when required? In the absence of a central bank, banks might seek alternative avenues for liquidity, such as establishing partnerships with global banks or engaging with international financial institutions—a strategy previously observed in dollarized economies. This external involvement not only has the potential to provide a substitute for the absent central bank support but also introduces a mechanism for instilling discipline within the banking system.

The critical concern that looms large revolves around the insufficient dollar reserves at the BCRA, which are a prerequisite to dollarizing the Argentine economy. This could hinder, delay, or even derail Milei’s dollarization plans, forcing him to explore alternatives to tackle inflation. Milei’s administration has the potential to eliminate exchange rate controls and facilitate the inflow of dollars. However, the challenge lies in executing this move abruptly without addressing fiscal imbalances, as it could lead to a substantial depreciation of the peso and, consequently, trigger hyperinflation. A more sensible solution could involve seeking additional reserves by borrowing from the IMF or international banks.

The execution of Milei’s dollarization plan draws inspiration from Emilio Ocampo and Nicolas Cachanosky’s book, Dolarización: Una Solución para la Argentina. Ocampo is even expected to be BCRA chairman under Milei’s administration. The plan comprises three phases. First, peso-denominated bank deposits are transformed into dollars at a predetermined fixed exchange rate, which would coincide with the market rate. It’s important to note that, for dollarization to be successful, banks are not required to hold the entire nominal value of deposits in dollar reserves. They must simply maintain adequate reserves in the central bank to cover customer cash withdrawals and fulfill other financial obligations, just as they do today. Simultaneously, loans and other financial assets on banks’ balance sheets are converted into dollars, allowing any new inflow of dollars into the banking system to facilitate this transition.

The second phase entails the conversion of the circulating pesos into dollars. The simplest approach is to encourage individuals to deposit their peso-denominated banknotes into their accounts, where they would be automatically converted into dollars. Alternatively, it could involve authorizing specific offices to facilitate the exchange of pesos for dollars at a fixed exchange rate within a designated timeframe. In either scenario, the BCRA would not be required to hold the entire sum of dollar reserves in advance.

The final phase represents the most intricate stage of the process, as it entails the conversion of the largest financial obligation on the BCRA’s balance sheet—namely, the Leliqs, which are liquidity bills issued by the central bank for conducting open market operations. Presently, these Leliqs, constituting approximately 43% of the total liabilities, reside on the balance sheets of banks. In essence, Ocampo and Cachanosky propose the establishment of a Monetary Stabilization Fund (MSF) with the primary objective of gradually liquidating these Leliqs. The MSF’s balance sheet would primarily comprise the BCRA government bond portfolio and other assets (to be more precise, the existing non-transferable bonds on the central bank’s balance sheet would have to be exchanged for a freshly issued set of dollar-denominated bonds, maintaining both their original nominal values and present values). The income generated from these assets would be utilized for the purpose of gradually retiring the Leliqs.

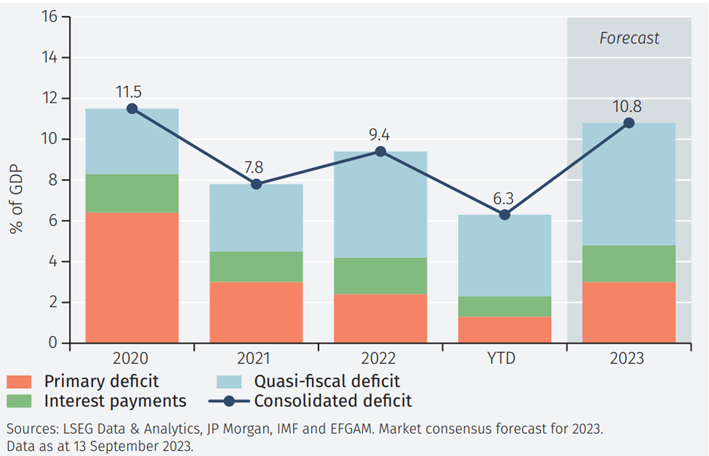

The second challenge involves tackling the consolidated fiscal deficit, projected to exceed 10% of GDP in 2023. This consolidated fiscal deficit encompasses the primary deficit, interest payments, and the quasi-fiscal deficit, which includes the interest-bearing liabilities of the BCRA. Milei has promised to cut down wasteful spending in order to diminish the primary deficit without compromising the quality of government services.

Achieving this goal appears challenging, given that a significant portion of government spending is allocated to essential areas such as education, healthcare, and other public services. And removing some government departments, as Milei proposes, will not save much money for the Argentine treasury. Nonetheless, the proposed dollarization plan could play a crucial role in addressing the quasi-fiscal portion of the consolidated deficit over the long term by resolving the issues associated with the Leliqs.

Consolidated Fiscal Deficit

A third challenge revolves around the regulatory burdens weighing down the Argentine economy. The latest OECD Economic Policy Reforms report highlights low productivity due to a lack of domestic and external competition, high trade barriers, and an elevated tax burden for business, all of which impede economic growth. Furthermore, Argentina occupies the 126th position in the Ease of Doing Business ranking elaborated by the World Bank, and its labor market is characterized by a sizeable informal sector (around 50% of the labor force) coupled with a decline in real wages over the last years.

In this context, Milei has proposed a series of loosely outlined reforms with the objective of unilaterally opening the economy to international trade, reducing taxes, and restructuring the labor market. However, he is likely to encounter significant challenges in implementing these reforms due to a lack of majority support in the Chamber of Deputies.

Finally, Milei’s administration faces the pressing challenge of addressing Argentina’s escalating poverty rates. From 2016 to the present, the national poverty rate has surged from 30% to surpass 40%, leaving approximately 12 million Argentinians struggling below the poverty line. A quarter of this demographic comprises unsheltered individuals.

While the ultimate solution lies in fostering inclusive economic growth through economic reforms, immediate measures are imperative. Milei must sustain or expand targeted programs specifically designed to alleviate poverty, recognizing the urgency of providing relief to those most affected by these distressing statistics. Similarly, curbing inflation, which especially affects the lowest deciles of the income distribution, is a sure way to decrease poverty levels.

The economic situation in Argentina is critical, and it could deteriorate further if Milei fails to steer the situation promptly. The key to success hinges on restoring monetary stability and preventing a recurrence of hyperinflation. If the new government can assert control over inflation through dollarization, the likelihood of successfully addressing other challenges and steering the economy back on course will significantly increase. Failure to do so will likely seal the fate of Milei’s administration.