It is a commonplace that American manufacturing is in decline. But is this true, and if it is, what are the appropriate remedies?

Two Rules to Tackle America’s Debt

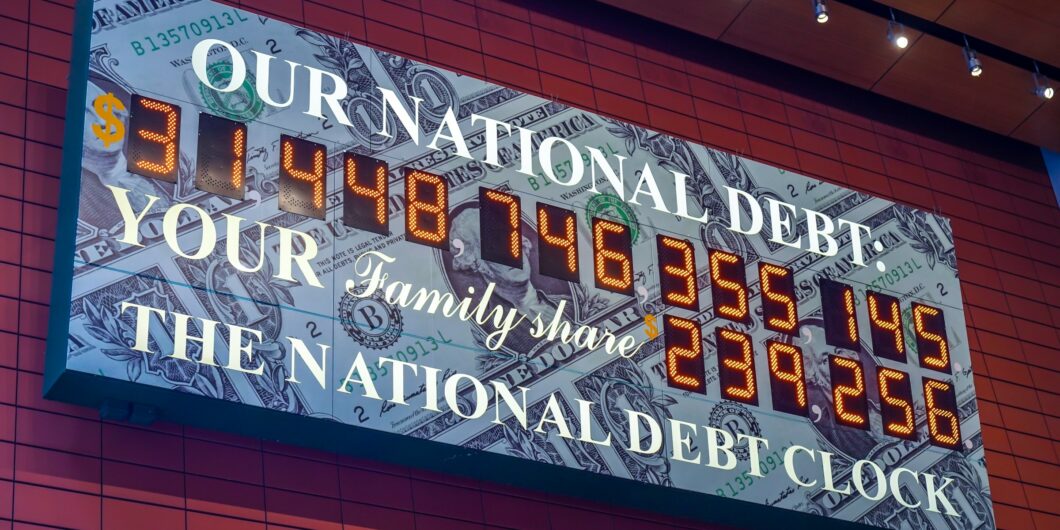

The Congressional Budget Office (CBO) just released the February 2024 Budget and Economic Outlook, and projections look grim. This year, net interest cost—the federal government’s interest payments on debt held by the public minus interest income—stands at a staggering $659 billion in 2023 and has recently soared to about $1 trillion. Unless politicians face these facts and restrain spending, Americans can expect rising inflation and painful tax hikes without improvement in public services.

Some politicians quickly blamed a lack of tax revenue, calling for repealing the 2017 Trump tax cuts. But how much more money can they take? New IRS data shows that 98% of all income taxes are paid by the top 50% of income earners, those making at least $46,637.

Moreover, 35% of Americans feel worse off than 12 months ago and inflation remains the primary concern for those across the income spectrum. So perhaps, rather than taking more money, the government should own up to its mistakes.

The massive net interest costs result from bad spending habits, not a lack of revenue. This requires the federal government to adopt strict fiscal and monetary rules to rein in wasteful deficit spending and money printing that fuel higher interest rates and inflation.

Net interest cost is the second largest taxpayer expenditure after Social Security and is higher than spending on Medicaid, federal programs for children, income security programs, or veterans’ programs. And it’s expected to grow.

The CBO projects net interest to surpass Medicare spending this year and balloon to $1.6 trillion in 2034 as a result of higher debt and higher interest rates. Interest rates on Treasury debt are at the highest since 2007, paying between 4% and 5.5%, and the rates are expected to rise further.

As the stockpile of gross federal debt is expected to grow by about $20 trillion to $54 trillion over the next decade, politicians will face an increasing temptation to rely on the Federal Reserve to pay for it by printing money. If the Fed does, the dollar’s value will decline, and Americans will continue to struggle financially.

In an ideal world, politicians will organize the budget process to focus on funding a limited government and ensuring Americans keep their hard-earned money. They would also have plans to cut spending during times of economic downturn to reduce tax burdens on families and businesses and avoid the Keynesian fallacies of deficit spending to fill gaps in economic growth.

However, America isn’t Shangri-La.

As Thomas Sowell poignantly notes, a politician’s first goal is to get elected, the second goal is to get reelected, and the third goal is far behind the first two. So long as there are investors happy to purchase Treasury debt, there will be politicians who are happy to sway voters with generous spending programs financed by public debt. This must end.

Proper constraints will nudge even the worst politicians to make fiscally responsible choices and reduce net interest costs.

Instead, Washington should require strong institutional constraints with a spending limit. The limit should cover the entire budget and hold any budget growth to a maximum rate of population growth plus inflation. This growth limit represents the average taxpayer’s ability to pay for spending. Following this limit from 2004 to 2023 would have resulted in a $700 billion debt increase instead of the actual increase of $20 trillion.

Such a policy has been in effect in Colorado since 1992. It is the Taxpayer’s Bill of Rights (TABOR) amendment to the Colorado Constitution. TABOR has revenue and expenditure limitations that apply to state and local governments. The revenue limitation applies to all tax revenue, prevents new taxes and fees, and must be overridden by popular vote. Expenditures are limited to revenue from the previous year plus the rate of population growth plus inflation. Any revenue above this limitation must be refunded with interest to Colorado citizens.

A spending cap like TABOR is necessary but not sufficient to solve the problem because politicians in Washington can still pressure the Federal Reserve to pay for the increased debt by printing money. Therefore, it must be combined with a monetary rule to force fiscal sustainability while requiring sound money with fewer distortions in the economy.

Monetary rules can come in many forms. While no rule is perfect, research shows that a rule-based monetary policy can result in greater stability and predictability in money growth than the current policy of “Constrained Discretion” whereby the Fed follows rules during “normal times” and has discretion during “extraordinary times.” Whether we are in ordinary or extraordinary times is up to policymakers, who typically don’t want to “let a good crisis go to waste,” as they say.

Milton Friedman advocated for a money growth rate rule, the “k-percent rule.” This rule states that the central bank should print money at a constant rate (k-percent) every year. A variation of this rule was used by Fed Chair Paul Volcker in the late 1970s and early 1980s to tackle the Great Inflation with much success. Unfortunately, the Fed had already done too much damage with excessive money growth before then, so the cuts to the Fed’s balance sheet contributed to soaring interest rates that forced destructive corrections in the economy, resulting in a double-dip recession in the early 1980s.

This led to the Fed abandoning money growth targeting in October 1982. It is important to note, though, that this “monetarist experiment” was not bound to any law, constitutional or statutory. During that time, the Fed still operated under discretion, which is why it was able to abandon the monetary growth rule just a few years after it had begun, unfortunately.

There are other rules that could be applied.

John Taylor proposed what’s been coined the Taylor Rule, which estimates what the federal funds rate target, which is the lending rate between banks, should be based on the natural rate of interest, economic output from its potential, and inflation from target inflation.

Scott Sumner most recently popularized nominal GDP targeting, which uses the equation of exchange to allow the money supply times the velocity of money to equal nominal GDP. It has different variations, but the key is that velocity changes over time, so the money supply should change based on money demand to achieve a nominal GDP level or growth rate over time.

By focusing on a rules-based approach to spending and monetary policy, Americans do not have to worry about electing the perfect candidate every election. Proper constraints will nudge even the worst politicians to make fiscally responsible choices and reduce net interest costs. Furthermore, America will be better positioned to respond to crises at home and abroad. If Congress wants to see who is to blame for the grim CBO projections, they should look in the mirror. Stop looking to take hard-earned money away from Americans and focus on sound budget and monetary reforms now.