America has enormous power, but the Biden Administration and the Federal Reserve are abusing it.

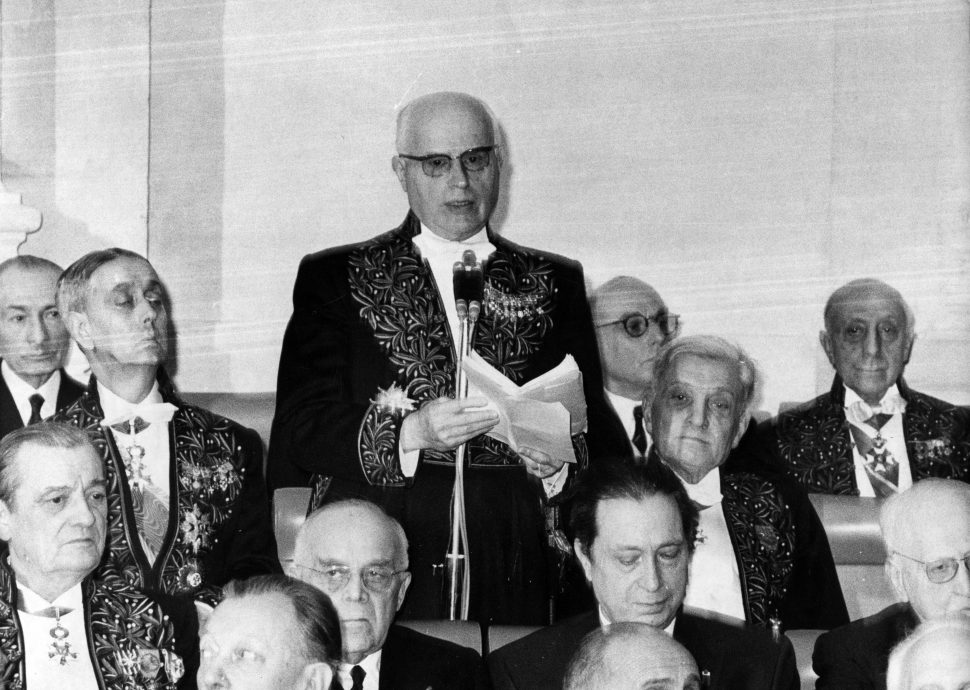

Jacques Rueff’s War on Inflation

Across the world, early-warning inflation signals are flashing. In May, the American Bureau of Labor Statistics reported that the all items index increased 4.2 percent over the last 12 months, the biggest annual increase since September 2008. That owes something to the Biden Administration’s success in getting most of its $1.9 trillion stimulus bill passed, which followed the $900bn pre-Christmas 2020 relief bill, as the U.S. Government seeks to force-feed purchasing power into the economy. Complimenting these measures, the Federal Reserve has increased its balance sheets to unparalleled levels. It also continues to purchase bonds as the world’s biggest economies re-open.

If—and that is a considerable “if”—America is teetering on the cusp of an inflationary outbreak, it won’t be confined to the United States. As long as the dollar is the world’s reserve currency, the impact will spread beyond America’s shores.

The good news is that we know how to purge excessive inflation from the economy. The problem is that reducing the money supply through raising interest rates and decreased bond prices tends to induce significant economic contractions. Businesses die, unemployment rises, and those on society’s margins suffer the most as inflation is burnt out of the economy. The anger that the effects of anti-inflationary policies generates among voters do not incentivize governments and central banks to go down this path. Consistently high inflation, however, is a cancer on the economy that, if ignored, will leave widespread economic and social destruction in its wake.

One economist who underlined this point repeatedly during the 20th century was the French monetary theorist and civil servant Jacques Rueff (1896-1978). A prolific author and one of the most prominent and earliest critics of John Maynard Keynes, Rueff is justly credited with designing the 1958 market-liberalization and monetary reforms that helped save France from imploding as a weak franc, the costs of the Algerian War, growing international uncompetitiveness, loose credit policies, and inflation-driven growth wreaked havoc on the economy and deepened social fractures in an already heavily divided country.

But the theme to which Rueff kept returning throughout his long career was how to establish and maintain monetary stability. For Rueff, the problem was not simply the economic damage inflicted by inflation. Rueff’s anti-inflationary stance was driven as much by normative concerns as his awareness of sound money’s indispensability for economic growth and social cohesion.

Devalue or Deflate?

Wars cost money, and one way in which the European powers paid the expenses of waging war on an unprecedented scale between 1914 and 1918 was by issuing mountains of paper currency. Pre-war financial giants like America, France, Germany, and Britain suspended the gold standard and resorted to inflationary finance. Germany went so far as to expand its money supply by 400 percent between 1914 and 1918.

In 1919, all these countries faced the same dilemma: how to bring the money supply back under control. One option was to take deflationary measures, the price of which would be a sharp economic downturn and high unemployment. The second was to devalue their currencies, which would hurt savers and creditors. While America and Britain chose deflation, France and Germany devalued.

The effects of devaluation on France and Germany made a lasting impression of Rueff, then a rising member of France’s elite Inspection générale des finances. That’s partly because of the attachment to savings and gold-backed currency which prevailed throughout French society, especially the Catholic middle-class. But Rueff also observed what happened in Germany as the Weimar Republic wandered down the path of systematic inflation to reduce the costs of war reparations. Rueff was fully cognizant of the economic hardship associated with deflationary policies. But the disastrous economic and political effects of Weimar hyperinflation between 1921 and 1923 convinced Rueff that letting the inflation-genie out of the lamp was highly irresponsible.

Throughout the 1920s and 1930s, Rueff’s pursuance of monetary stability found expression in different forums. He played a role, for instance, in the Poincaré government’s successful stabilization of the franc in 1926. Rueff also emerged as an advocate of a return to the classic gold standard as a way to inhibit governments from using monetary manipulation to avoid making the hard fiscal decisions necessary for the general welfare. As French governments of left and right wrestled with the Great Depression in the 1930s, Rueff used his senior position in the Ministry of Finance to fight for monetary stability against those who wanted to combat the economic downturn with colossal public works programs and highly-expensive welfare policies, all of which was to be funded by printing money and enormous deficit-spending.

Rueff did not think that governments should do nothing in times of severe crisis. He did maintain, however, that any action should occur within the parameters imposed by balanced budgets and disciplined monetary policy so as to inhibit inflationary tendencies. Such a position conflicted with the prescriptions of the Cambridge academic across the Channel whose influence would only magnify in the subsequent decades.

Against the Keynesian Tide

It was after World War II that Rueff came into his own as an inflation hawk. In that respect, he was something of a rarity. As the Federal Reserve’s own history of the period relates “After the war ended in 1945, most policymakers were concerned with preventing another Great Depression” and its deflationary effects. The Fed’s history then observes, however that “inflation proved to be a much greater concern. Between June 1946 and June 1947 Consumer Price Index (CPI) inflation was 17.6 percent [in America], and from June 1947 to June 1948 it was 9.5 percent. . . . By February 1951, CPI inflation had reached an annualized rate of 21 percent.”

From Rueff’s standpoint, once inflationary pressures intensified, the consequences for liberty and social cohesion were grave.

On the other side of the Atlantic, inflation also reared its head. In France’s case, a major source of inflationary pressures was government efforts to modernize France’s economy—or, more precisely, how that modernization was funded. Here successive Fourth Republic governments relied upon Marshall Plan credits, deficit-spending, and a loosening of medium-term credit by the Banque de France. This had been nationalized in 1945, thereby giving the government more direct control over monetary policy. These developments occurred in a context whereby (with the exception of West Germany, thanks to the influence of ordo-liberals like Wilhelm Röpke and Walter Eucken), neo-Keynesian ideas were the new Western European economic orthodoxy. This meant that an inflation-rate higher than what most political leaders would otherwise accept was considered a price worth paying for economic modernization.

Rueff was deeply out of sympathy with these dirigiste trends. While he supported updating France’s industrial base, Rueff objected to this being planned by governments from the top-down, the manner by which it was financed, and the inflationary implications of that approach. The latter started to become evident in France in the mid-1950s. Inflation in France reached 15.35 percent in 1958. While it subsided in the early 1960s, inflation took off again in 1968, before exploding in the 1970s and didn’t start to decline substantially until 1984.

Although Rueff identified domestic policies as partly responsible for this turn of events, he also argued that what he called “l’âge de l’inflation” owed much to the Bretton Woods System. This had decreed that all national currencies would be valued in relation to the U.S. dollar as the dominant reserve currency, with the dollar being convertible to gold at the fixed rate of $35 per ounce.

A major problem with the dollar-exchange standard, Rueff noted, was that it allowed America to run a balance of payments deficit without experiencing any contraction of domestic credit. The subsequent overflow of dollars into the world economy heightened inflationary pressures. Since World War I, Rueff had been passionately pro-American, but one reason why he supported a return to something close to the pre-1914 classic gold standard was his belief that it would force America to embrace greater fiscal and monetary discipline and thereby put a brake on the indiscriminate growth of credit throughout the world.

Rueff’s hawkish views on inflation and the doggedness with which he expressed them didn’t make him popular with most of the postwar economics profession or the monetary policy establishment. The tenacity which Rueff brought to advocacy of his positions didn’t, however, simply reflect professional disagreement about monetary policy’s proper ends or technical disputes about how central banking could influence growth and employment. From his standpoint, once inflationary pressures intensified, the consequences for liberty and social cohesion were grave.

Rueff wrote on this theme in many places, but perhaps most concisely in an address entitled “Inflation et liberté” delivered at a Mont Pelerin Society meeting in Princeton in 1958. Rueff’s address begins by claiming that “It is inflation which, much more than socialism, destroys the possibilities for liberty in the world.” That’s quite a statement, but Rueff then proceeded to list methodically how inflation, left unchecked, could bring about such a state of affairs.

Inflation kills freedom

“The essential feature,” Rueff argued, of inflation was that it burdened the price mechanism with a supplementary task: the effective levying of a concealed tax upon those with fixed incomes as well as individuals and families whose incomes were derived from salaries and wages. The fact that this tax was surreptitious and not formally authorized by a legislature invested inflation, he thought, with a downright anti-democratic character.

Moreover, Rueff maintained, inflation’s steady reduction of the purchasing power of salaries and wages demoralized large segments of the population and radicalized others. The latter included workers and unions who would do whatever they thought necessary (including strike-action) to secure wage-rises that, at a minimum, kept track with inflation or, preferably, exceeded it. Inflation also generated resentment against those unaffected by it, not to mention those who actually benefited from inflation, such as debtors.

These tears in the social fabric weren’t, according to Rueff, the only political ramification of accelerating inflation. Governments, he thought, would be anxious to avoid the unpopularity associated with anti-inflationary policies like tightening the money supply or balancing the budget by reducing government spending and raising taxes to reduce excessive demand.

Instead, Rueff argued, governments would be severely tempted to try and force the pace of growth through measures such as massive deficit spending in an effort to outrun inflation. That, however, only added fuel to the fire. Should things continue down this path, Rueff thought it likely that governments would end up imposing price-controls, rationing and other forms of planning in an attempt to suppress out-of-control inflation by government fiat. The inevitable diminution of economic liberty would not, he believed, bode well for freedom more generally.

By the time of his death in 1978, Rueff must have considered himself somewhat vindicated. Much of what he predicted regarding inflation had come to pass in Western economies during the 1970s. The Great Inflation, as it came to be called, lasted from 1965 and 1982. Two American presidents, Richard Nixon and Jimmy Carter, even tried using price controls to address the problem. Western Europe was roiled by waves of strikes throughout the seventies as militant unions demanded pay-rises that matched spiraling inflation rates. Indeed, if some governments and central bankers—most notably, the Federal Reserve’s Paul Volker—had not summoned up the fortitude to implement highly-unpopular deflationary measures from 1979 onwards, it’s likely that inflation would have run amuck in the West in the 1980s.

Happily, some Western policymakers turned out to be tougher and more clear-eyed about inflation than Rueff expected. That said, Rueff’s writings about inflation and its monetary and political consequences are always worth re-reading. They demonstrate the economic and moral indispensability of sound monetary policy for not only stable long-term growth but also basic honesty in the development and implementation of government policy. Few messages could be more pertinent for economic decision-making in our time.